[ad_1]

The recent signals from the Bank of England about the future of raising interest rates brought the GBP/USD exchange rate more bearish momentum in the past week. The currency pair tried to rebound higher, but its gains did not exceed 1.3182. It then returned to close the week’s trading near the support level 1.3086, closer to breaching the psychological support 1.3000. The pound was one of several smaller currencies that benefited from the waning of the US dollar’s dominance of central bank foreign exchange reserves late last year, according to newly released International Monetary Fund data, but the overall basket may look very different after that time.

Central banks bought more currency reserves last quarter, raising the total value of reserves allocated by about 0.7% to just over $12.05 trillion in the IMF’s latest report on the composition of foreign exchange reserves. Despite a growing basket, the share of the US dollar fell to 58.81% from 59.21% in the previous three months, bringing to a new all-time low.

When measured in US dollars rather than as a percentage of the basket, the Canadian dollar saw the fastest growth while its holdings of the renminbi, the pound sterling, the Swiss franc and “other currencies” rose as well. However, last quarter’s scroll order was affected by changes in the value of each currency relative to the dollar, and in addition to the performance of each country’s government bond markets, so it is not necessarily an accurate reflection of the allocation change.

Given that the dollar, the euro, the yen, the British pound and the renminbi account for the bulk of all reserves, it is almost inevitable that any sale in the first quarter would have been concentrated in these currencies, and this has led to a decline in their respective shares in the basket during that period.

Final survey data from S&P Global on Friday showed that growth in UK manufacturing activity moderated significantly in March, reflecting persistent supply shortages, increased caution among customers, escalating inflationary pressures and geopolitical tensions. Accordingly, the S&P Global / Chartered Manufacturing Purchasing Managers’ Index fell to 55.2 in March from 58.0 in February. The expected reading was 55.5.

All five sub-components of the PMI had a negative impact on its March level. Industrial production grew at the slowest pace in five months in March. New orders grew at the slowest pace during the current 14-month increase streak in March. Meanwhile, export orders contracted for the sixth time in the past seven months. Inflationary pressures increased in March. Input price inflation hit its highest level in three months. Average selling prices also rose at the fastest pace in three months. Sellers’ lead time has been extended for the 33rd consecutive month and again to one of the largest ranges in survey history. Employment expanded for the fifteenth consecutive month.

Finally, manufacturers maintained a positive outlook in March, with more than 55 percent expecting production to rise over the next 12 months.

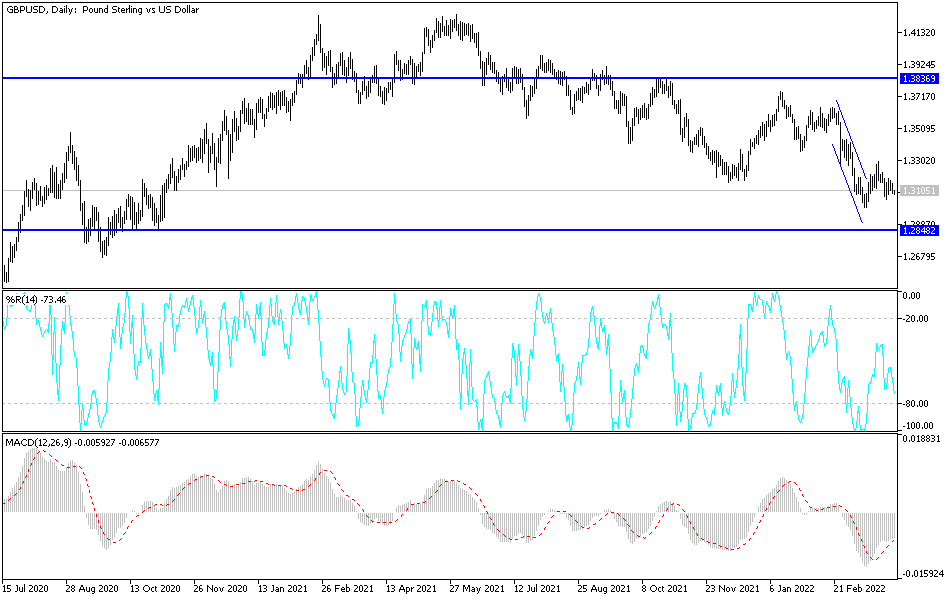

On the daily chart below, the price performance of the GBP/USD currency pair appears to be forming a head and shoulders after the failure of the recent rebound attempts. Continuation of the formation may push the bears to breach the 1.3000 psychological support. After the recent disappointment with the future of the Bank of England’s policy, the momentum of the US dollar will be stronger regarding the future of raising interest rates, which will put pressure on any attempts by the GBP/USD to rebound higher. The closest resistance levels for the pair are currently 1.3185, 1.3230 and 1.3300.

I confirm now that the breach of the 1.3335 resistance is important for the bulls to continue controlling the trend.

[ad_2]