[ad_1]

For the second day in a row, the price of the EUR/USD currency pair is trying to bounce up and get out of the sharp bearish channel that dominates the performance in the recent period. The rebound gains for the currency pair did not exceed the 1.1137 level, and it is settling around the 1.1110 level at the time of writing the analysis. The euro-dollar losses this week reached the level of 1.0944, and the rebound gains came amid cautious optimism about renewed negotiations between Russia and Ukraine and the decline in global crude oil prices.

There are no major reports out of the Eurozone this week, so the EURUSD may take clues from mainly US data. This includes the core PCE price index, which is said to be the Fed’s preferred inflation measure, and the non-farm payrolls report due on Friday. The inflation report may show a slight reduction in price pressures, but a stronger-than-expected reading may boost hawkish hopes for the upcoming FOMC meeting. Analysts expect the figure to fall from 0.5% to 0.4%.

The US Non-Farm Payrolls (NFP) report is also set to show a slower recovery in employment for March, but an upward surprise could mean solid gains for the greenback. Overall, analysts expect an increase in employment of 485K for this month, down from the previous gain of 678K. Note, however, that the last two reports have printed stronger than expected results, and the previous numbers were enjoying upgrades.

The results of a closely followed survey revealed that consumer confidence in Germany is expected to weaken more than expected in April, influenced largely by concerns about the war in Ukraine. According to the results, the forward-looking consumer confidence index declined to -15.5 from a revised -8.5 in March, market research growth GfK reported. Economists had expected a reading of -14.

The agency added that the downward trend in the main index continued and was reinforced by the sharp increase in the propensity to save in March. Commenting on the results, Rolf Berkel, consumer expert at GfK, said: “In February, hopes were still high that consumer sentiment would recover significantly with the expected easing of pandemic-related restrictions.” But the outbreak of war in Ukraine made those hopes fade.” Burkell noted that the growing uncertainty and sanctions against Russia have caused energy prices to rise in particular, putting a significant pressure on general consumer sentiment. The survey’s income expectations index fell 25 points to -22.1, the lowest value since January 2009 when it was -22.9 on the back of the global financial crisis.

GfK said purchasing power is affected by rising inflation mainly caused by rising gas, heating oil and gasoline prices. Citing one of its recent surveys on the consequences of the war in Ukraine, GfK said that nine out of ten Germans are very concerned or very concerned about the sharp rise in prices in the energy sector, and about 80 percent expressed concern about groceries prices.

Economic forecasts fell in March after two consecutive increases. The index lost 33 points to -8.9 points, the lowest level since May 2020, during the first Covid-related closure, when it was at -10.4 points. GfK said that risk factors, including recession risk, clearly dwarf the positive motivation expected from easing measures.

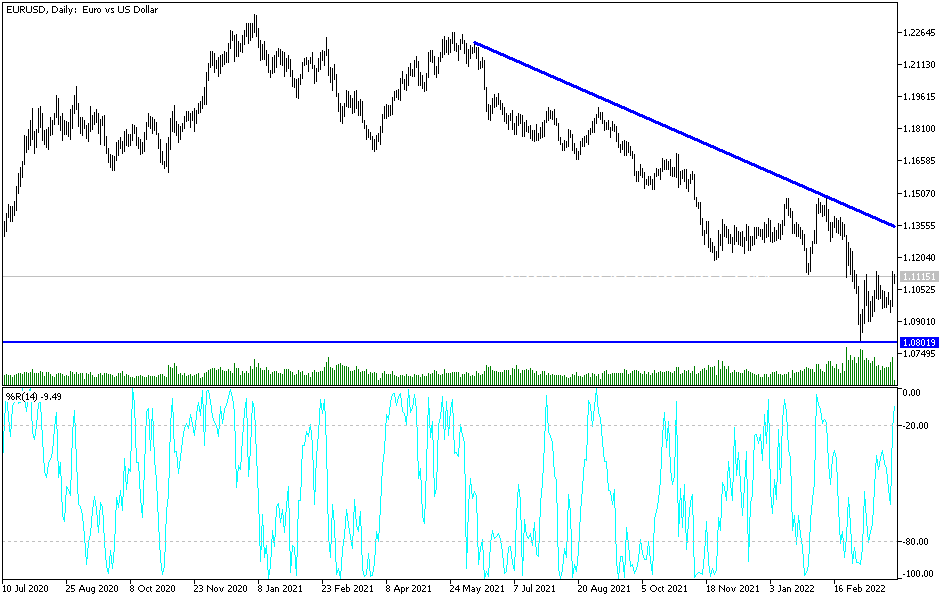

According to the pair’s technical analysis: EUR/USD is trending lower on the hourly chart, forming lower tops and lower levels within a descending channel. The price is rising and gradually getting close to testing the top of the channel. The Fibonacci retracement tool shows that this is in line with the 61.8% Fibonacci and the key psychological level of 1.1000, making it a strong resistance area. The price is currently testing 50% Fibonacci which aligns with the 100 SMA dynamic inflection point. If any of these hold up as resistance, EUR/USD may resume its decline to swing low around 1.0950, a minor psychological mark.

The stochastic has room to rise but is approaching an overbought area to reflect the exhaustion among the buyers. A turn lower could mean sellers are ready to come back and allow selling to resume. The RSI has more room to go up before reaching the overbought zone to indicate that buyers are about to take a break.

[ad_2]