[ad_1]

The recent selling operations witnessed by the GBP/USD currency pair stopped at the support level of 1.2100, bouncing back from the resistance level of 1.2293 and settled around the level of 1.2145 in the beginning of trading today, Thursday. Ahead of the most important event for the sterling pairs, which is the monetary policy decisions of the Bank of England, followed by the next most important event, which is the US jobs numbers on Friday. This will have an impact on the market expectations of the future of raising US interest rates. Barclays forex analysts say sterling is likely to head lower after Thursday’s BoE update, but Goldman Sachs is more positive regarding the outlook for the British currency, especially against the euro.

The Bank of England’s Monetary Policy Committee is expected to announce another rate hike before releasing its latest inflation and economic growth forecasts. Prior to that, the pound strengthened against both the euro and the US dollar during the latter part of July and early August and the major test of the currency comes with the size and shape of the announced rise.

It is noted that the biggest downside risk to the pound comes in the form of disappointing the British central bank against market expectations by raising another 25 basis points. This is because the market is now almost completely “priced” up 50 basis points and based on various comments from MPC members and the June statement that it is now ready to act “aggressively” in order to control inflationary impulses. In this regard, Marek Rachko, an analyst at Barclays, agrees. “A 50 basis point delivery could lead to an unexpected rally in sterling, while a 25 basis point move should see a bigger selloff,” Rachko says.

Barclays expects the British central bank to raise 50 basis points, in line with the consensus. However, “any rally should be short-lived or reverse quickly as we expect the Bank’s updated forecasts to show stagflationary stagflation impulses.” This will be a repeat of the May policy update, in which the bank raised interest rates but released a set of forecasts showing inflation will slip below the 2.0% target over the medium term while growth will drop to negative by the end of the year.

All in all, the Sterling fell following the May update, and trended lower against most of the major currencies over the following weeks. However, the GBP/EUR exchange rate has received better support since the Bank of England’s June update as it said it was prepared to act more “aggressively” on inflation. Since then, it has risen again above 1.19 and the GBP/USD exchange rate has returned to 1.22 this week.

Barclays expects just one additional 25 basis points in September, with the bank leaving the final interest rate at 2%.

This would prove to be a major failure in capturing current market rates and pose a significant downside risk to the pound’s exchange rate levels. Currency analysts at Goldman Sachs are more positive regarding the prospects for the Pound Sterling, especially against the Euro. They expect the MPC to raise 50 basis points in a break from the “most gradual and balanced approach” taken so far this year that favored delivery in 25 basis point increases.

However, the FX team acknowledges that a 50 basis point hike would represent an important change in the bank’s approach, “and the Fed’s return toward a more balanced strategy makes the BoE somewhat less anomalous.”

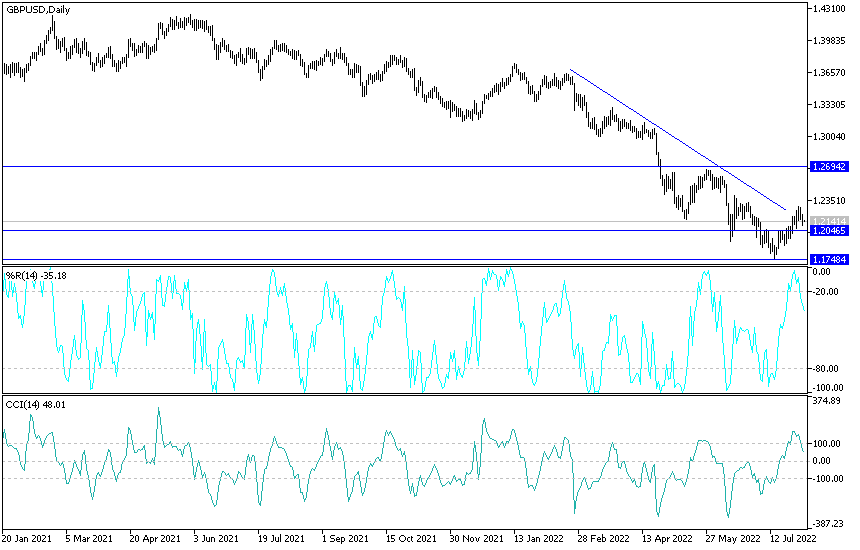

GBP/USD forecast today:

I have often recommended selling the pound sterling against the dollar (GBP/USD) from every bullish level. This is especially with the recent performance, as the markets have already priced in the Bank of England’s move today to raise interest rates. In return, the US dollar is taking advanced levels in front of everyone before the announcement of US jobs numbers, along with the return of investor appetite. Technically, the pound sterling dollar breaking the support level of 1.2100 will force the bears to move further downwards, and accordingly the most prominent downward move will be the support level 1.1965.

On the upside, and according to the performance on the daily chart, the GBP/USD pair needs to test the resistance levels 1.2330 and 1.2400, respectively, to stabilize the bullish outlook.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]