[ad_1]

After the Federal Reserve announced the US interest rate hike, as expected, the price of the US dollar against the Japanese yen gained an upward momentum. This led to it towards the level of 137.45, but the currency pair did not enjoy gains for long, as it returned to retreat to the support level 136.40 following comments from the governor. Federal Reserve officials raised US interest rates by 75 basis points for the second month in a row, providing severe tightening in more than a generation to curb rising inflation – but they risk delivering a heavy blow to the economy.

US monetary policy makers, facing the hottest price pressures in 40 years, raised the target range for the federal funds rate on Wednesday to 2.25 percent to 2.5 percent. This brings the cumulative increase from June to July to 150 basis points – the largest rise since Paul Volcker’s anti-price era in the early 1980s.

In its statement, the FOMC said it was “strongly committed to returning inflation to its 2 percent target,” it said in a statement issued in Washington, repeating previous language that it was “extremely concerned with inflation risks.” The FOMC reiterated that it “expects that continued increases in the target range will be appropriate”, and that it will adjust policy if risks arise that may impede achieving its objectives.

US stocks remained high after the decision. Short-term Treasury yields rose, and the dollar fell.

FOMC Meeting Updates

The FOMC vote, which included two new members, Vice President for Supervision Michael Barr and Boston Fed President Susan Collins, was unanimous. Adding Barr to the board of directors earlier this month gave him a full line-up of seven governors for the first time since 2013.

Officials have been criticized for underestimating inflation and slow to respond, and they are now aggressively raising interest rates to cool the economy, even if it threatens to push it into recession. And higher prices are already having an impact on the US economy. The effects are particularly evident in the housing market, where sales have slowed.

While Federal Reserve officials assert that they can manage a so-called “soft landing” of the economy and avoid a sharp deflation, a number of analysts say the recession with rising unemployment to significantly slow price gains. The Federal Open Market Committee noted that “recent indicators of spending and production have declined,” but it also noted that job gains “have been strong in recent months, and the unemployment rate has remained low.”

The recent increase puts US interest rates close to the Fed policy makers’ estimates of neutrality – a level that neither speeds up nor slows down the economy. Forecasts in mid-June showed officials expected to raise rates to about 3.4 percent this year and 3.8 percent in 2023. Investors are now watching to see if the Fed will slow the pace of rate increases at its next meeting in September, or If strong price gains pressure the central bank to continue the large-volume hikes.

Central banks around the world are fighting a battle against rising prices. Earlier this month, the Bank of Canada raised interest rates by a full percentage point and surprised the European Central Bank with a half-point larger-than-expected move, its first increase in more than a decade.

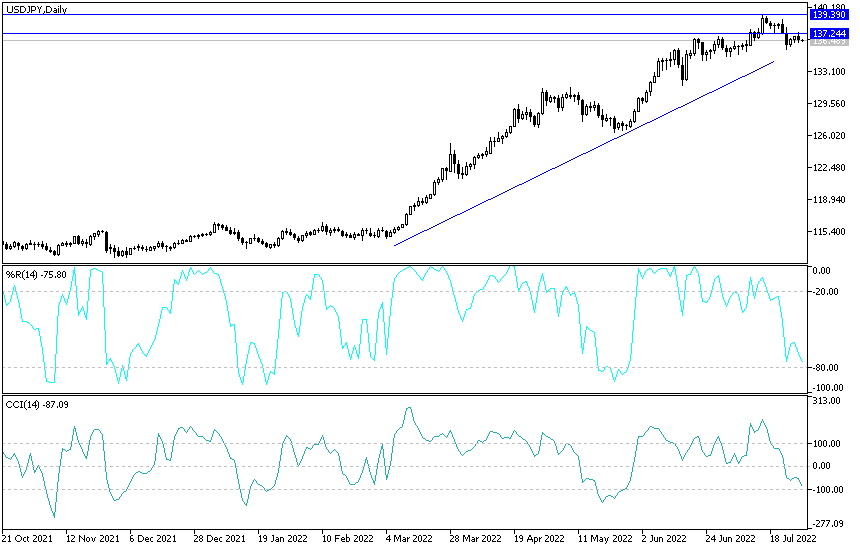

USD/JPY Daily Forecast:

Despite the recent stability, the USD/JPY currency pair is still maintaining the bullish trend. The first reversal of the general trend will not occur according to the performance on the daily chart without the currency pair moving below the 134.40 support level. I still prefer buying USD/JPY from every bearish level. On the other hand, and over the same time period, breaking the resistance 137.85 will be important for the bulls to launch towards the awaited psychological top 140.00 at the earliest time. Today’s US dollar pairs will be affected by the announcement of the US economic growth rate.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]