[ad_1]

Despite the halt in the US dollar’s gains, the gains of the GBP/USD currency pair did not exceed the 1.2063 level and settled around the 1.2000 level at the beginning of this important week’s trading. This confirms that the British pound is still bearish pressure factors. The US dollar is still the strongest with expectations of raising interest rates and investors’ demand for it as a safe haven. In contrast, UK inflation is running at its fastest pace since the early 1980s. Therefore, the Bank of England has stuck to raising interest rates compared to its trans-Atlantic counterpart. And mounting labor and supply chain wounds left by Brexit.

All of which is sterling near levels last seen when the Covid-19 panic and shutdown was in full force.

Add to Britain’s long-standing concern about low productivity, and Ulrich Lochtmann, currency analyst at Commerzbank AG, said: “The new British government is taking charge in a difficult situation.”

GBP Economic Data

Investors and analysts agree: Regardless of whether Secretary of State Liz Truss or former Treasury Secretary Rishi Sunak wins the leadership race, the forces behind the pound’s slide may prove beyond their powers to counter it. Volatile energy prices and an already tight labor market have left BoE policy makers teetering between aggressive rate hikes and the need to protect the economy from rising prices. With its open economy and massive current account deficit, Britain is vulnerable to global conflict. Inflation will lead the pace of growth in any of its major European peers over the next two years, according to economists polled by Bloomberg.

Since Brexit, the pound has become a more “marginal” component of investors’ currency holdings, according to Bank of America analysts Kamal Sharma. This leaves it particularly vulnerable to worsening investor sentiment globally as Russia’s invasion of Ukraine and China’s war on Covid continues to hurt the local economy.

Using global stock markets as a proxy, the British pound has become steadily more sensitive to global risk appetite.

While Britons are feeling the brunt of a weak sterling when shopping for goods shipped from abroad, the country’s central bankers are watching the impact on price growth as costly imports add to the inflationary pressure. The decline in the Bank of England’s preferred measure of the pound’s strength this year has added about 0.5 percentage point to the pace of inflation, according to Bloomberg’s SHOK economic model.

Bank of America forecasts a recession in the UK in 2023 due to high inflation.

More expanded fiscal support from the government may seem like the obvious answer to supporting struggling families, but there is a risk that it could drive up inflation and make the BoE’s job more difficult. The candidates’ pledges to cut taxes could add fuel to higher prices and require additional tightening from the central bank.

Barrow believes that the pound could fall further to $1.15 against the dollar in the coming months. Sterling’s drop of more than 11% against the dollar this year has forced BoE policymakers to take note: Catherine Mann said she backed a 50 basis point increase to help support the currency, twice the size of the BoE’s recent moves.

This may to some extent narrow the interest rate gap between the central bank and the US Federal Reserve. The Bank of England raised rates by 115 basis points over six months, compared to 150 basis points by the Fed in half the time. The Bloomberg measure of the dollar’s strength is close to at least an 18-year high. The British pound is certainly not the only one facing a rally in the US currency. The factors that afflict sterling are also not unique to the UK. The euro fell to parity against the dollar for the first time in 20 years this month, while the European Central Bank has only now published its first rate hike since 2011.

GBP/USD Technical Forecast:

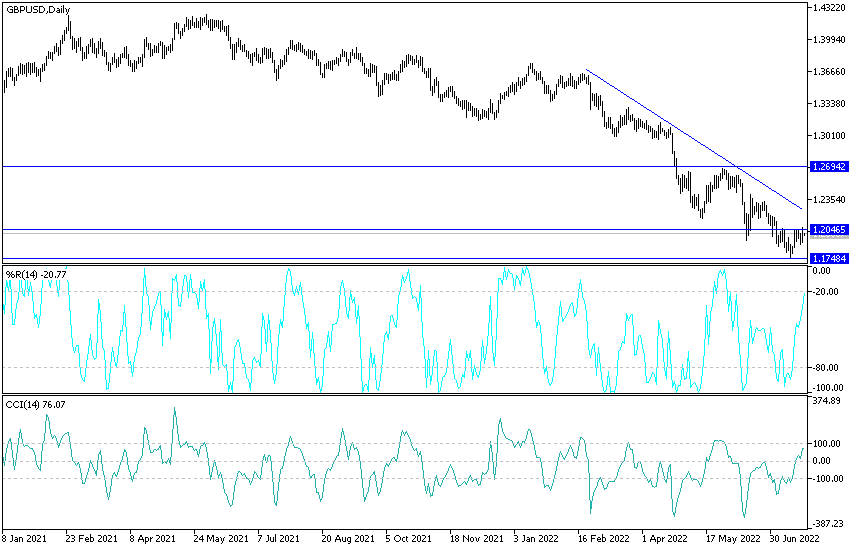

In the near term and according to the hourly chart, it appears that the GBP/USD currency pair has recently completed an upward breach of forming a gently descending channel. This indicates bulls trying to control the pair. Therefore, they will look to extend the current rebound towards 1.2042 or higher to 1.2083 resistance. On the other hand, the bears will target potential pullback profits at around 1.1967 or lower at 1.1929.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.1805 or lower to 1.1533. On the other hand, the bulls will look to pounce on profits at around 1.2258 or higher at 1.2562.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]