[ad_1]

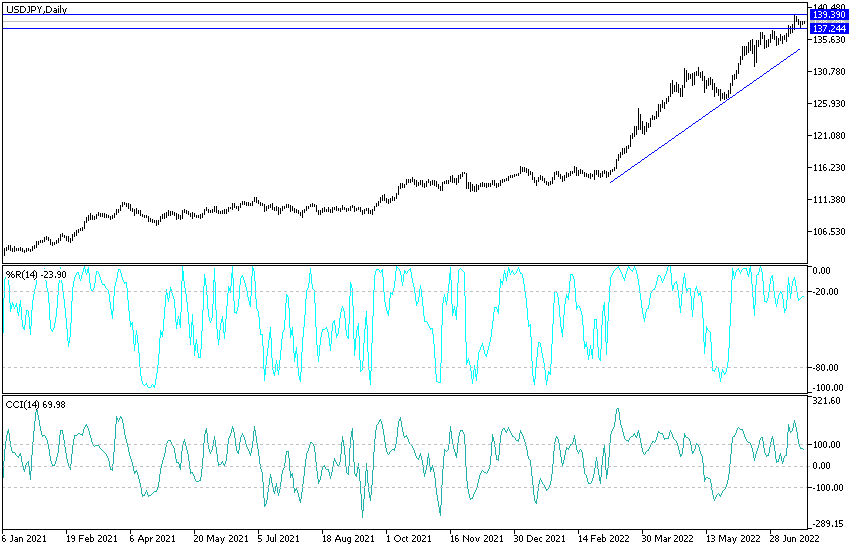

For five trading sessions in a row, the price of the USD/JPY currency pair is moving in narrow ranges between the level of 137.38 and the level of 138.55. It is stable near it at the time of writing the analysis. The US and the Japanese central bank and the government continued to ignore the collapse of the Japanese yen to its lowest in 24 years.

Bank of Japan and the Future

For investors trying to figure out how to play in the US Treasury market, the Bank of Japan is one of the biggest unknowns. Treasuries and other major bond markets have been shaken significantly this year, but a new round of volatility and spikes in yields could erupt if the BoJ follows other global central banks by abandoning its easy monetary policy in the face of rising inflation.

While the European Central Bank is widely expected on Thursday to raise interest rates for the first time since 2011 and questions about Fed policy revolve around how quickly and how tough officials may be, the rate hike in Japan is in question.

The Bank of Japan was the first global bank to preach ultra-loose monetary policy, using tools such as quantitative easing and yield curve control, and it is set to be among the last to abandon it. This has left one of the few fulcrums globally still connecting markets to the era of easy money, so a change of course could spread across Treasuries and elsewhere.

At their meeting this week, BoJ officials are expected to keep interest rates low to stimulate the country’s economy as increases in consumer prices remain lower than those seen in other advanced economies. The drop in the Japanese yen is adding to speculation about how long Japan can hold out in the face of a hawkish shift among global central banks, injecting new uncertainty into global bond markets.

If it changes course, analysts say Treasury yields could jump higher, albeit temporarily, by signaling an official end to the era of global easy money. Meanwhile, it could also revive the purchase of Treasuries by Japanese investors who were on the sidelines as the US dollar rose, or even lower long-term yields by ramping up the risks of a global slowdown.

Overall, the pessimistic attitude of the Bank of Japan has contributed to the sharp weakening of the Japanese yen, which has pushed it down more than 16% this year against the dollar and pushed it to the lowest level against the dollar since 1998. Over the past two months, 10-year Treasuries have hedged the yen. The return on investors based in Japan has fallen to around zero from 1.30%, which reinforces why the country is largely absent from the treasury market for most of the year. Some investors view the possibility that the Bank of Japan will surprise the markets in the coming months by removing the 0.25% yield cap on 10-year bonds as a potential buying opportunity for US and Eurozone bonds.

This is because the Bank of Japan will probably prefer to stick to its current policy stance until next April when Governor Haruhiko Kuroda’s current term ends. But analysts say, “the bank’s hand could be forced up front” by rising inflation there, “at least thanks to the weak yen, or because of higher yields in the US” that continues to attract money. However, the magnitude of the global bond shock from the BoJ’s turnaround may be short lived as investors are already anticipating weaker growth in Europe and the United States, which are putting downward pressure on long-term yields.

The 10-year US Treasury yield, now just above 3%, is about 20 basis points lower than the more policy-sensitive two-year yields, a so-called yield curve inversion that shows investors expect interest rates will eventually be lowered. In general, the economy is weakening due to tightening financial conditions.

USD/JPY Forecast Today:

There is no change in my technical view of the USD/JPY currency pair, as the general trend is still bullish. The opportunity to break through the 140.00 psychological resistance is possible, as the factors of the US dollar’s strength are still continuing. As mentioned before, this includes profit-taking sales, as the technical indicators reach overbought levels, but every pullback is followed by new purchases of the currency pair. The closest support levels for the dollar are currently 137.65 and 136.80, respectively.

[ad_2]