[ad_1]

Despite the recent gains, euro exchange rates face the possibility of a few very volatile days of trading. This week brings with it the European Central Bank policy meeting as well as the planned restart date of the NordStream 1 gas pipeline. The interest rate decision from the European Central Bank certainly has the potential to move the price of the Euro. However, the expected rate hike has been priced in advance, and anti-fragmentation tool news is also expected. Thus, the primary impact on the Forex markets is whether or not NordStream 1 will restart, given that it remains Russia’s geopolitical trump card.

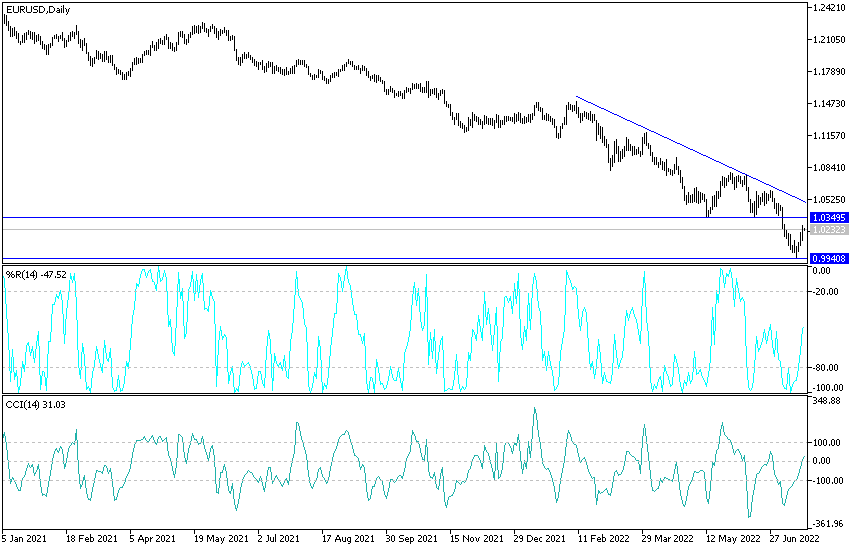

For three trading sessions in a row, the price of the EUR/USD currency pair is moving in a bullish rebound range with gains to 1.0270, its highest level in two weeks, and its sharp losses recently pushed it towards the 0.9952 support level, the lowest since 2002.

Overall, if Russian gas flows resume, analysts say the euro is likely to recover, with Goldman Sachs analysts estimating gains in the 0.5-1.0% region. But by far the biggest risk to the EUR is to the downside if gas supplies do not resume.

“The possibility of a prolonged gas outage is likely to swing above the euro throughout the week,” says Zack Bundle, Forex analyst at Goldman Sachs.

Nord Stream 1 carries gas via a pipeline from Russia to Germany and is currently undergoing planned annual maintenance, which is scheduled to be completed on July 21, making this the most important item on the euro calendar this week. There are fears that Russia could delay reopening and undermine Europe’s efforts to refill exhausted capacity before winter.

French Economy Minister Bruno Le Maire said last week, echoing similar concerns voiced by his German counterpart Robert Habeck: “Let’s prepare for a total cutoff of Russian gas; Today that is the most likely option.” Ahead of the key date on Thursday, Russia’s Gazprom declared force majeure on gas supplies to Europe for at least one major customer, according to a July 14 letter from Gazprom and seen by Reuters on Monday.

The letter said that Gazprom, which has a monopoly on Russian gas exports through pipelines, could not fulfill its supply obligations due to “extraordinary” circumstances beyond its control. This already indicates that gas supplies to the EU will be well below capacity at any restart. Accordingly, Goldman Sachs says the destruction of demand will involve either higher prices or government rationing in parts of Europe, leading to recessions in Germany and Italy. “The question is, how much gas will flow on July 22?” says Matthew Hornbach, an analyst at Morgan Stanley. The fear in Europe among households, businesses and politicians is that the gas will not flow.” He adds: “If there is no gas flow, even for a short period, the risks to Europe will tilt towards a deep recession rather than the technical recession that our European economists are currently expecting.”

This week therefore promises to be a very risky one for the euro, which only last week fell below parity against the Dollar, albeit for a while. However, the EUR/USD started the new week’s trading with a rise again above 1.01, but against the pound sterling, the currency was much softer. Analysts are of the view that additional headwinds for the euro could come from the possible announcement of an extended 10-day maintenance period for NordStream1 pipelines this Thursday, further depleting German gas stocks ahead of winter and exacerbating growth expectations in the eurozone.

EUR/USD Forecast

Despite the recent gains, the price of the EUR/USD currency pair is still in a sharp bearish trend range. There will be no reversal of the general trend without the EUR/USD moving towards the resistance levels of 1.0500 and 1.0665 respectively as is the performance on the daily chart. On the other hand, breaking the support level at 1.0150 will support the bears once again to move below the parity price. Today, the EUR/USD price will react to the announcement of German producer prices, current accounts and consumer confidence in the Eurozone. Then there will be the announcement of existing US home sales. It may remain in a narrow range until Thursday’s important European Central Bank announcement.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]