[ad_1]

During last week’s trading, the gold price experienced strong selling that pushed it towards the support level of $1732 an ounce, its lowest in nine months, and tried to recover slightly to $1752 on Friday. But the strength of the US labor market numbers contributed to closing the price of gold around the level of $1742 an ounce. The price of gold was negatively affected by the strength of the US dollar and investors are waiting for a stronger gold buying base.

Is now YOUR time to trade gold ?

Don’t let fear prevent profits!

Trade Gold Now!

According to economic analysis, gold trading was affected by the announcement that the US non-farm payrolls for the month of June exceeded the expected number of jobs at 268 thousand with a count of 372 thousand new jobs. On the other hand, the average hourly wage growth for the month was 5.1%, which is slightly higher than the expected (year-on-year) growth of 5%, while its equivalent (monthly) was flat at 0.3%. The US unemployment rate for the month also matched estimates of 3.6%, unchanged from May.

Earlier in the week, initial jobless claims for the week ending July 1 missed expectations at 230K with 235K. Continuing claims for the previous week came in at less than 1.327 million, with the number of claims rising by 1.375 million. On the other hand, the ISM Services PMI for June beat expectations at 54.5 with a reading of 55.3. Prices of paid ISM services fell from the expected 83.9 with a reading of 80.1, while both the Employment Index and the New Orders Index PMI came in lower than the 49.8 and 62.1, respectively with 47.4 and 55.6.

The main concern in Wall Street markets is centered around the US Federal Reserve’s efforts to rein in inflation, and the risks its plan could push the economy into recession. The US central bank has already raised its key overnight interest rate three times this year, and the increases are becoming increasingly violent. Last month, it raised interest rates by the most since 1994, by three-quarters of a percentage point to a range of 1.50% to 1.75%. It was almost zero until March.

And by making borrowing more expensive, the Fed has already slowed some parts of the economy. The housing market in particular has slowed as mortgage rates rise due to the Fed’s actions. Other parts of the economy have also shown signs of slowing, and confidence among consumers has fallen sharply as they face the highest inflation rate in four decades.

The hope on Wall Street was that the recent mixed data on the economy could persuade the Federal Reserve to ease the rate hike. This week’s pause from higher oil and other commodity prices helped boost these hopes. But Friday’s jobs report may have weakened them. Last Friday’s volatile trade came ahead of this week’s major report on consumer inflation. The US consumer price index, which came in May at its highest level since 1981, is expected to show an 8.8% increase over the 12 months ending in June, according to FactSet.

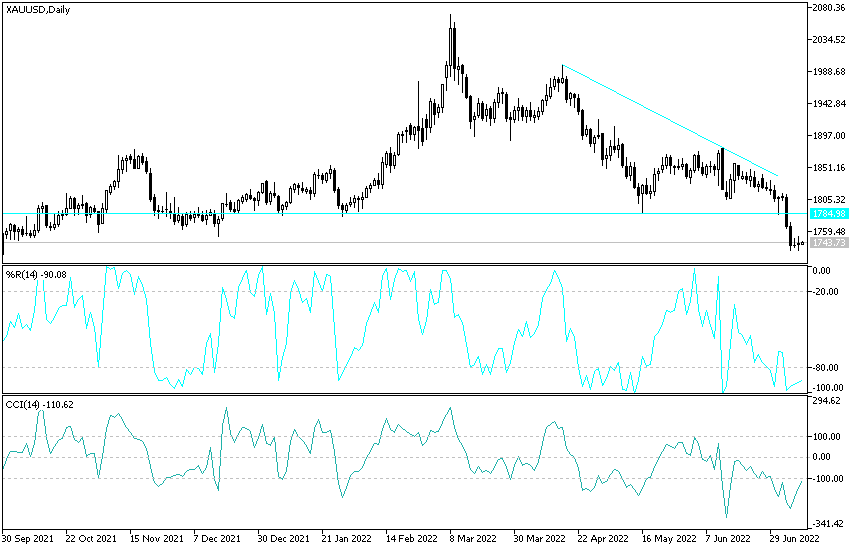

Technical analysis of gold

In the near term and according to the performance on the hourly chart, it appears that the XAU/USD gold price is trading within a neutral channel formation. This indicates that there is no clear directional bias in market sentiment. Therefore, the bulls will target short-term profits at around $1,747 or higher at $1,752. On the other hand, the bears will look to pounce on earnings around $1,737, or lower at $1,733 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will be looking to extend the current declines towards $1,722 or lower to the $1,702 support an ounce. On the other hand, the bulls will target potential bounces around $1,762 or higher at $1,786 an ounce.

[ad_2]