[ad_1]

Throughout the last week’s trading the price of the EUR/USD currency pair is trying to rebound higher to break the general bearish trend. However, the price of the euro still lacks enough momentum to succeed in that.

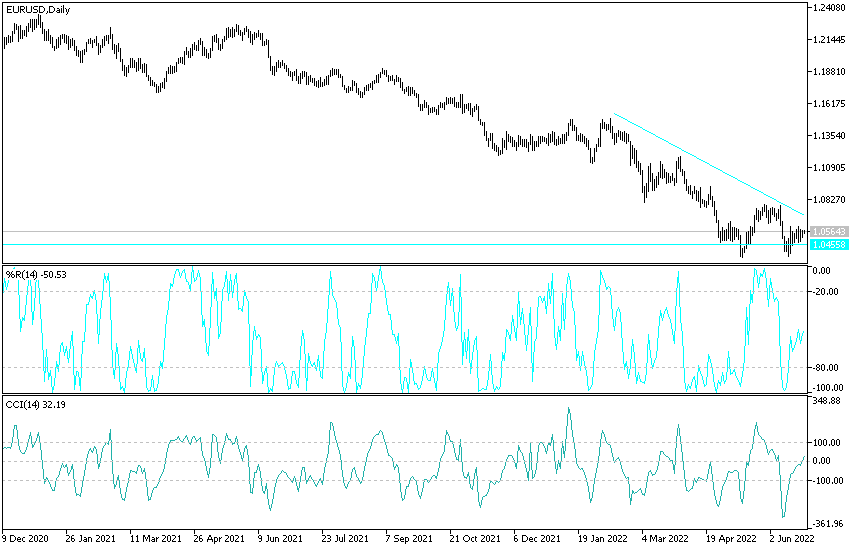

The last retracement to the highest resistance level 1.0605. The clear contrast in the future of monetary policy tightening between the US Federal Reserve and the European Central Bank continues to support the bearish trend.

A day after endorsing Ukraine’s candidacy to join the European Union, the bloc’s leaders on Friday turned their attention to severe economic turmoil looming over the coming months as the full impact of the Russian war recedes and the threat of recession grows. So, the 27 EU leaders gathered in Brussels to confront rising inflation, energy shocks, waning business and consumer confidence, and mounting budget pressures. Leaders will also have to contend with higher borrowing costs as the European Central Bank prepares to raise interest rates for the first time in 11 years to counter wild price increases. European Central Bank President Christine Lagarde, who plans to raise interest rates next month and again in September, joined an EU summit to discuss the bleak economic outlook.

“We are in a difficult situation,” Swedish Prime Minister Magdalena Andersson said on her way to the summit. and “It is very important that we have this discussion.” The European Union has spent the past decade battling a series of crises, from Greece’s financial woes and the transatlantic trade turmoil under former US President Donald Trump to Brexit and the COVID-19 pandemic.

The European Commission, the European Union’s executive arm, on Friday announced plans to issue 50 billion euros ($52.7 billion) in EU bonds to aid member states between July and December as part of a pioneering economic recovery program. With no end in sight to the war in Ukraine, the European Union committed to toughening sanctions against Russia as a sanction, the bloc must combat economic threats on multiple fronts.

Energy is a major challenge for the European Union, which for years has relied heavily on oil, natural gas, and Russian coal to help power cars, factories, heating systems and power plants. Under pressure to keep up with US and British sanctions against Russia, the European Union since April has expanded what was already unprecedented by targeting Russian fuel. A ban on Russian coal imports will start in August and a ban on most oil from Russia will be implemented in phases over the next eight months.

Meanwhile, Moscow itself is disrupting natural gas deliveries, which the EU has not included in its own sanctions for fear of seriously harming the European economy. Before the war, the bloc got about 40% of its gas needs from Russia.

Already, Moscow has reduced gas supplies to five EU countries, including heavy importers Germany and Italy, and cut shipments to six member states, such as Finland. Accordingly, last Thursday, Germany launched the second phase of a three-phase emergency plan for gas supplies, saying that the country was facing a “crisis”. Weaknesses in Germany, Europe’s largest economy, risk having a spillover effect making the latest EU economic growth forecasts look very rosy.

In May, the European Commission said that the EU’s economic output would grow by 2.7% this year and 2.3% in 2023 after growth of 5.4% in 2021. Other forecasts have already lowered growth forecasts. At the start of this year, the bloc was still facing the effects – including a rising budget deficit – from the pandemic, which caused the economy to contract 5.9% in 2020.

For its part, the European Central Bank pledged to create a market pillar to protect the 19 countries that share the euro currency from market turmoil while tackling record 8.1% inflation. The selling of bonds from some euro countries was a central feature of the debt crisis a decade ago.

EUR/USD analysis:

Despite the recent rebound attempts, the general trend of the EUR/USD is still bearish, and the return of stability below the 1.0500 support level will support the bears to launch further lower. The next support levels for the pair will be 1.0425 and 1.0380, respectively. The last level is sufficient to push the technical indicators towards oversold levels. However, the Euro still lacks sufficient momentum to break out of the current trend.

A technical exit may occur if the currency pair moves towards the resistance levels 1.0685 and 1.0800, respectively. The Euro is not awaiting important and influential data today. From the US, durable goods orders and US pending home sales will be announced.

[ad_2]