[ad_1]

The euro was not very happy with the rebound gains last week after steps and comments by the monetary policy officials of the European Central Bank

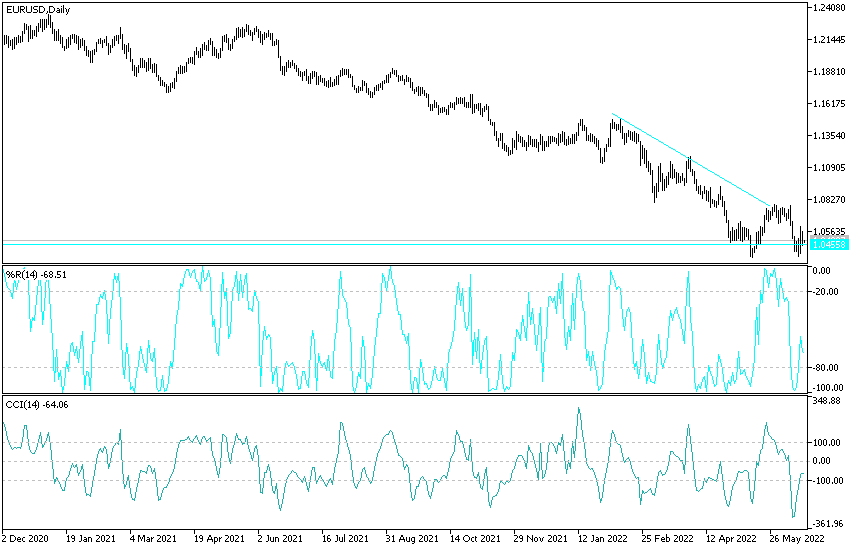

The exchange rate of the euro currency pair against the dollar EUR/USD rebounded to the level of 1.0600 and then returned to decline in its broader path to the downside to the support level 1.0444. It settled around the level 1.0485 at the beginning of this week’s trading. She confirmed with the recovery of the euro that the clear contrast for the future of monetary policy tightening between the European Central Bank and the US Federal Reserve is still in favor of the strength of the US dollar.

Last week, the US Federal Reserve raised its key short-term interest rate by three times the usual amount for the largest increase since 1994. It could consider another massive increase at its next meeting in July, but Fed Chairman Jerome Powell said increases by three Quarters of a percentage point would not be common. The Fed has also just started letting some trillions of dollars in bonds it bought during the pandemic off its balance sheet. This should put upward pressure on long-term interest rates which is another way for global central banks to pool previously backed support under the markets to prop up the economy.

The Fed’s moves occur as some disappointing signs are emerging about the economy, even if the labor market remains strong. The latest report released on Friday showed that US industrial production was weaker last month than expected. Other disappointing data, including falling retail spending and declining consumer confidence, have raised concerns that the Fed’s actions could be too aggressive. Jerome Powell will testify before Congress this week about monetary policy, and what he says will surely guide trading. Testimony is scheduled for Wednesday and Thursday, which could mean more sharp volatility in global financial markets.

In addition to the policy of the European Central, there is the Russian-Ukrainian war and its negative repercussions on the future of economic recovery. As the crisis dragged on, Russia slashed natural gas back to Europe as countries worked to reduce their dependence on Russian supplies amid the war in Ukraine. Friday marks the third day of deep cuts to fuels that support industry and generate electricity in Europe, which also hit Germany and Austria.

This has pushed up already high energy prices and led to record inflation in the European Union. The Russian side informed the state-controlled gas company of Slovakia that it would reduce the flow of gas to the country by 50%. Russian energy giant Gazprom also told Italian gas company Eni that it would supply only 50% of the gas needed on Friday. France no longer receives any natural gas from Russia.

According to the technical analysis of the pair: The return of stability in the price of the euro currency pair EUR/USD below the support level of 1.0500 will support the bears to move further downwards. The support levels at 1.0420, 1.0375 and 1.0290 may be the most important for the bears in the general trend of the bearish currency pair. On the daily chart below, the EUR/USD needs more strong and continuous momentum to get out of this trend and there may be signs of that if it moves towards the 1.0645 and 1.0775 resistance levels, respectively.

Today is an American holiday, and it will affect market liquidity and investors’ desire for adventure. On the same day, there will be statements by European Central Bank Governor Lagarde.

[ad_2]