[ad_1]

The Euro also gained some momentum from the ECB Governing Council members holding an unscheduled meeting on Wednesday to discuss recent issues related to bond movements in the Eurozone.

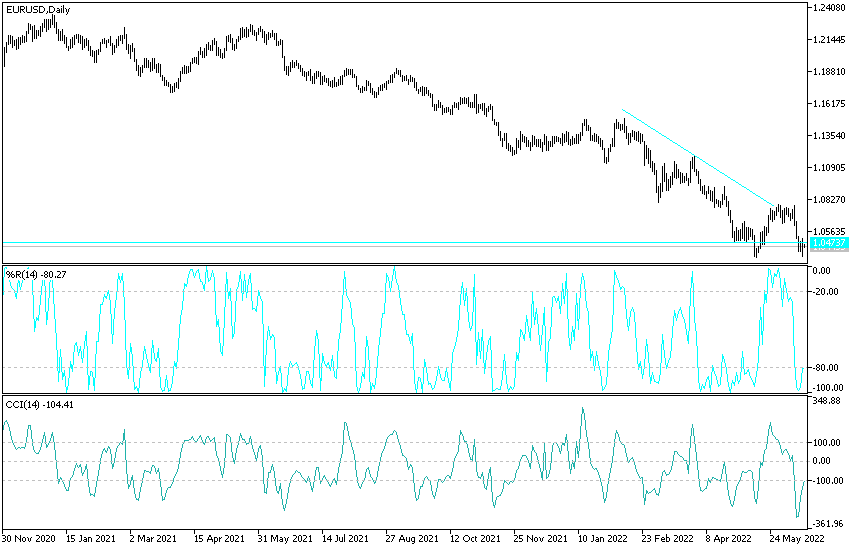

The US Central Bank announced a stronger-than-expected interest rate hike and calmed Jerome Powell, governor of the bank. The strong demand for buying the US dollar, and the price of the currency pair EUR/USD gained momentum to rebound upwards, starting from the support level 1.0359 to the level of 1.0507 and settled around the 1.0445 level at the same time. The bears still have the strongest control over the performance of the most popular currency pair in the forex trading market.

The Euro also gained some momentum from the ECB Governing Council members holding an unscheduled meeting on Wednesday to discuss recent issues related to bond movements in the Eurozone. The market has taken this as a sign that the European Central Bank is serious about dealing with the possibility of an unregulated bond market in the Eurozone, which supports the euro exchange rates.

The developments come after bond yields in “peripheral” eurozone economies – such as Italy and Greece – rose sharply in response to recent indications by the European Central Bank that it will raise interest rates in July and again in September. Notably, peripheral bond yields rose faster than those of core eurozone countries, such as Germany and France. This widening of the eurozone yield spread worries the eurozone and markets as it revives memories of the eurozone debt crisis in early 2010.

For his part, a spokesman for the European Central Bank said: “The Board of Directors will hold a special meeting to discuss the current market conditions.” The market reaction was positive as it indicated that the ECB will not sleep and enter another crisis. The European Central Bank is expected to work quickly in developing tools to ensure that the eurozone market continues to function, thus reducing the existential risks to the euro. Commenting on this, Elias Haddad, chief currency analyst at CBA says: “EUR/USD rose towards 1.0500 and spreads around the eurozone narrowed sharply amid expectations that the European Central Bank will announce measures to deal with the increasing retail risks in the bond markets. Sovereignty in the Eurozone.

The intervention comes as the euro extends its 2022 lead against the pound, but falls further toward parity against the US dollar.

ECB Governing Council member Isabelle Schnabel said before that that the ECB had “no limits” in its commitment to defending the eurozone, citing concerns that euro zone spreads are trending upwards. Schnabel also said the European Central Bank was ready to launch a new instrument to counter any “disorderly” jump in borrowing costs for weaker eurozone economies.

The main concern for investors since the European Central Bank said at its policy meeting last week that it will raise interest rates in July is how it will intervene to tackle retail financial markets. “Our commitment is stronger than any specific tool,” Schnabel added. Our commitment to the euro is our anti-fragmentation tool. This commitment has no limits. Our track record of intervening when needed supports this commitment.”

Today’s meeting could test the ECB’s resolve. If the European Central Bank presents a compelling roadmap to contain the bond markets, the euro exchange rates may rise further, but any disappointment could be painful.

According to the technical analysis of the pair: the recent rebound, the EUR/USD price did not break out of the bearish trend, and it is still stabilizing below the 1.0500 support. This confirms the extent of the bears’ control over the trend. The recent losses moved the technical indicators towards oversold levels, but the Euro lacks strength factors so far. Investors’ balancing of the US central bank’s announcement and the ECB’s recent steps may give some hope of an upward correction. The closest support levels for the currency pair are currently 1.0390 and 1.0280, respectively.

On the daily chart, the bulls move to breach the 1.0770 resistance, which will support the rebound strength to the upside, otherwise the bears will continue to control. There are no important European economic data, and the focus will be on the US session data, where jobless claims will be announced, the Philadelphia Industrial Index and US housing data will be announced.

[ad_2]