[ad_1]

Ignoring the Japanese government and the Central Bank of Japan, the recent collapse of the Japanese yen in the forex market allowed the USD/JPY to move strongly higher. It broke its highest level in 20 years, and the currency pair reached the top of the dollar. The US dollar is still the strongest with interest rate hike expectations. This is a major reason for the recent rocketing rise of the currency pair.

In contrast to the performance of the currency pair, the dollar fell after international trade data showed that US demand for imported consumer goods declined during April in a result that may be related to the Fed’s monetary policy expectations. The dollar was broadly bought in mid-week trading, resulting in gains on almost all major currencies, although the trend was reversed somewhat after the Census Bureau released its trade balance estimate for April.

The deficit decreased from $107.7 billion in March (revised) to $87.1 billion in April, as exports increased and imports declined. The Census Bureau added that the March deficit, which was previously published, was $109.8 billion. The US trade deficit fell sharply during April due to an economically supportive increase in exports and a decrease in imports which should also boost GDP. The data is likely to carry with it a pessimistic message about how far the price may need to be in US interest to go up later this year.

Subsequent declines of the US dollar have been widespread and more noticeable against currencies with global central banks that are either in the process of raising interest rates or about to raise interest rates in order to curb their own runaway inflation rates.

One explanation for the market’s response to the data may be that the decline in imports is indicative of a cooling in consumer demand for manufactured consumer goods among households, which has been an important source of inflation in the US recently and is something the Federal Reserve has openly begun to curb. “The main challenge facing the economy is unacceptably high inflation, which reflects the imbalance between strong aggregate demand and constrained aggregate supply,” Loretta Meester, president of the Federal Reserve Bank of Cleveland, told the Philadelphia Council on Business Economics last week.

“There has been strong demand in the face of very limited supply in both the product and business markets. Product markets have had to deal with a succession of disruptions in supply chains, reflecting differences in virus conditions and virus containment policies around the world.” The Fed is seeking to use monetary policy to reduce consumer demand to a level that is in better balance with the restricted supply of commodities noted above, and this is a major part of the reason why policy makers have been more hawkish in their statements over the recent months.

The FOMC is committed to using its inflation-control tools, on a downward path to its long-term 2% inflation target and has begun the process of monetary policy repositioning. Loretta Meester added that this recalibration reflects evolving economic conditions, the economic outlook, and the risks surrounding the outlook, and as re-calibration continues, it will continue to do so.

Overall, these types of data affect all financial markets as well as general financial conditions within the economy, conditions that have tightened significantly since June of last year and the point at which the Fed first began signaling that it would soon look to tighten its monetary policy.

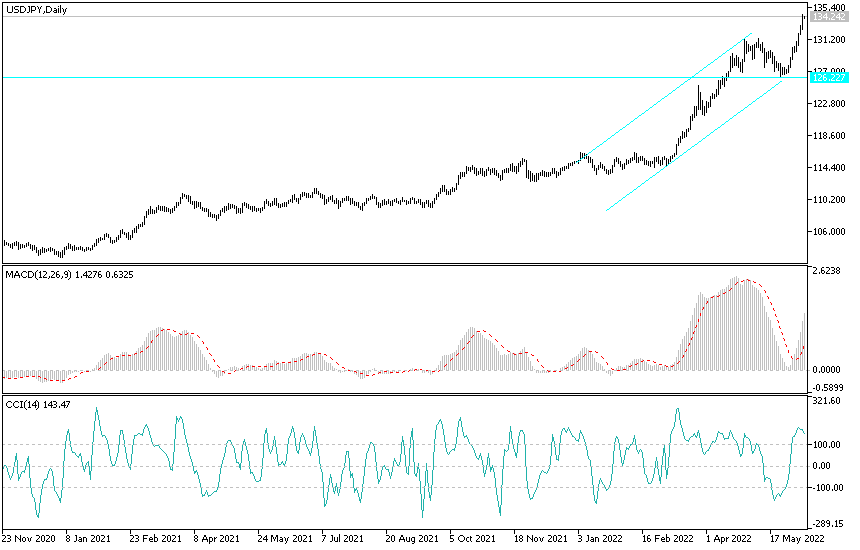

According to the technical analysis of the pair: The general trend of the USD/JPY pair is still bullish, and the continuation of its gain’s factors mentioned above will ensure control of testing stronger ascending levels amid a clear ignoring of the movement of some technical indicators towards overbought levels. The closest to the trend is now levels of 134.85 and 136.00, respectively. According to the performance on the daily chart, to breach the current ascending channel, we must break 129.80. The currency pair may remain on track until the release of US inflation figures tomorrow.

[ad_2]