[ad_1]

The price of the EUR/USD currency pair is still moving amid bullish momentum, which was able to move towards the resistance level 1.0786, recovering from its lowest level in five years. The euro’s gains came primarily due to a hawkish ECB policy escalation and a favorable international tailwind but will likely require continued support for both this week if overcoming technical resistance is immediately loomed in the market.

In general, the single European currency, the euro, rose further last week, recording its first set of consecutive weekly gains since the early days of the second quarter of last year. This is after China took steps to ease restrictions related to the Corona virus in Shanghai, and with policy makers in the European Central Bank signaling to a more hard-line policy stance. Allocations have been set for reopening Shanghai to advance further over the weekend while restrictions on activity in the Chinese capital, Beijing, have also been eased, which is important for the euro against the dollar given the extent of its losses since the last “lockdown” early in April.

The EUR/USD price fell from around 1.10 to 1.0349 between the April opening and mid-May and an important part of this decline was driven by developments in China and price action in the RMB exchange rates.

Anything supporting China’s economic recovery or normalization of the country’s foreign trade is noteworthy for the eurozone given that 10% of the bloc’s exports went to the world’s second-largest economy in 2021, which was also the source of 21% of eurozone imports. However, the general direction of the dollar and the monetary policy of the European Central Bank are also major influences, and both are likely to respond on Tuesday when Eurostat releases its estimate of eurozone inflation in May, which the market expects to rise from 7.5% to a new record high of 7.7% .

Some analysts doubt that the European Central Bank will actually raise interest rates in the eurozone with a larger-than-usual 0.5% increase in July, which will end the era of negative interest rates in Europe, but they note the risks of speculation in the markets in this direction over the coming weeks. This comes after several ECB board members, including ECB Governor Christine Lagarde and chief economist Philip Lane, expressed their support for higher borrowing costs that could end the era of negative interest rates in Europe any time before the end of the year.

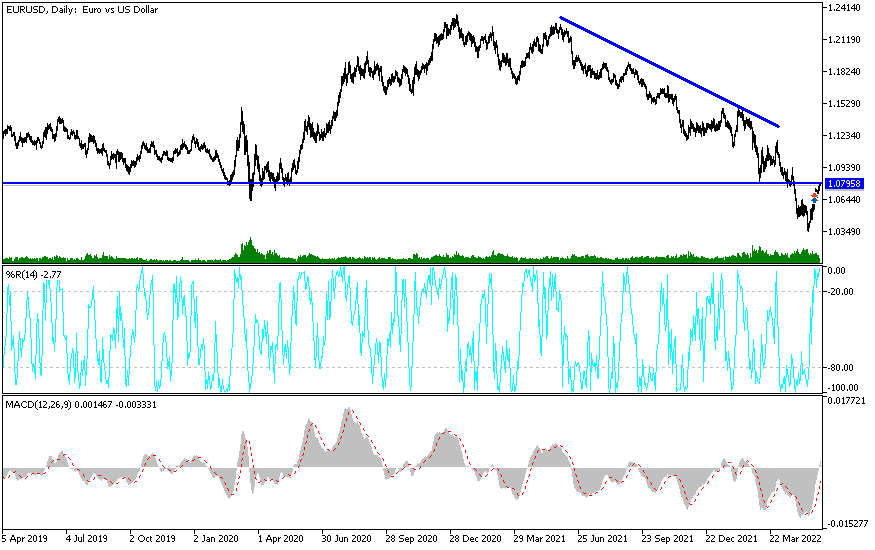

According to the technical analysis of the pair: EUR/USD formed lower highs associated with a descending trend line that has been stable since mid-2021. It seems that the price has come for another test of this resistance, which lines up with the Fibonacci retracement levels on the daily time frame. As the 61.8% Fibonacci level is around the 1.0870 level and the closest to the trend line resistance. The price is already testing the 50% level around the 1.0770 level, which might also be enough to keep gains in check. If any of these levels hold, the euro against the dollar may resume falling to the swing low at 1.0340 or lower.

In the long term the 100 SMA remains below the 200 SMA to confirm that the general trend is still bearish and that selling is more likely to resume than reverse. The 100 SMA lines up with the trend line adding to its strength as resistance. The stochastic is already indicating overbought or exhaustion levels among buyers, so a turn lower means sellers are taking over. The RSI has a bit more room to go up, so buying pressure can continue and the correction may continue until overbought conditions materialize.

[ad_2]