[ad_1]

The buyers are becoming just a bit more aggressive as of late.

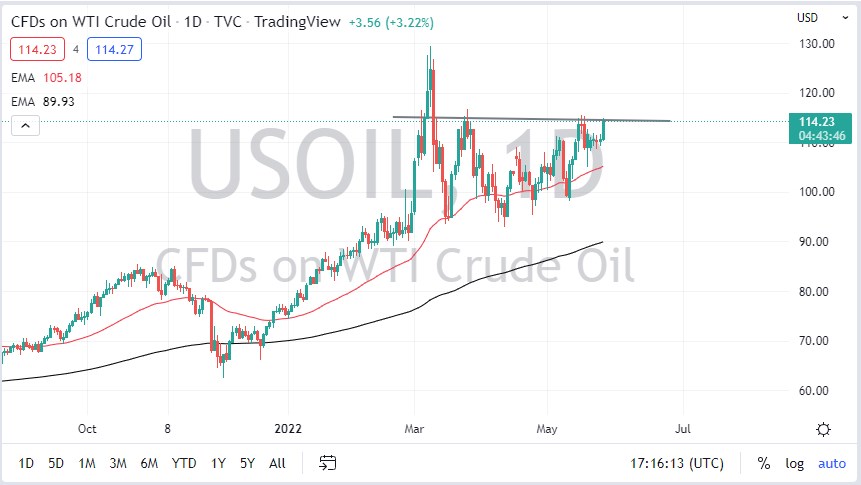

The West Texas Intermediate Crew Oil market rallied during the training session on Thursday to slam into the $115 level. As you can see on the chart attached, I have drawn a line at that area, and you could make an argument for some type of ascending triangle, or something similar to it at this point. I like the idea of buying dips, and I do think that every time this market pulls back there will be buyers willing to step in and try to take advantage of any type of value.

The 50 Day EMA is sitting at the $105 level and is rising. Ultimately, I think that it offers dynamic support as you have seen multiple times in the past, but I would think of it more as a “spongy area” as it hasn’t acted like a trend line. In fact, you could even make an argument for an uptrend line underneath that level, and it coincides quite nicely with the $100 level. The $100 level is a large, round, psychologically significant figure, so I think that if you were to break the role of that, then you can start to have an argument to the downside. Nonetheless, this is a market that I think will remain bullish for the foreseeable future, but not quite as strong as in the past.

On a break above the $116 level would clear the market for a move to the $120 level, possibly even the $125 level. I think at this point in time, we will more likely than I see that happen, because of everything that’s going on with the crude oil supply around the world. We continue to see a lot of concerns when it comes to the Russian supply as well, even though they are selling crude oil to a handful of major importers, such as China and India.

Think of this as a market that you need to find value in, and I would also point out that the most recent dip was much shallower than the three previous dips before that. That suggests that we are starting to see a build in momentum, and I do think that is something that’s worth paying attention to. In other words, the buyers are becoming just a bit more aggressive as of late.

[ad_2]