[ad_1]

Gold futures contracts continued to achieve their gains, supported by the decline in the price of the US dollar. The gains of the gold price reached the level of 1870 dollars per ounce, then returned to stability around the level of 1858 dollars per ounce.

In general, the yellow metal was trying to withstand in the face of a myriad of developments that would make it difficult for the rise in gold prices, especially on the monetary policy front. It shows the demand that the public has for the precious metal.

All in all, gold prices are now trading at their best levels since May 11, driven by a weaker US dollar. Since the beginning of 2022 to date, the price of gold has increased by more than 1%. Silver, the sister commodity to gold, made modest gains. As silver futures rose to $21.723 an ounce. The white metal has fallen more than 7% over the year and more than 22% in the past 12 months.

Gold was surprisingly resilient during a rally in global financial markets and may have benefited from the weak dollar.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 102.11 and a weak profit is a good thing for dollar-denominated commodities as it makes them cheaper to buy for foreign investors. Higher Treasury yields capped gold’s rally, with 10-year bond yields at 2.859%. One-year yields rose 2.6 basis points to 2.1026%, while 30-year yields rose 0.4 basis points to 3.07%.

The gold market is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion. However, market analysts acknowledge that gold prices have benefited from lower nominal and real rates.

In other metals markets, copper futures fell to $4,335 a pound. Platinum futures fell to $943.40 an ounce. Advanced palladium futures contracts to 1976.00 dollars an ounce.

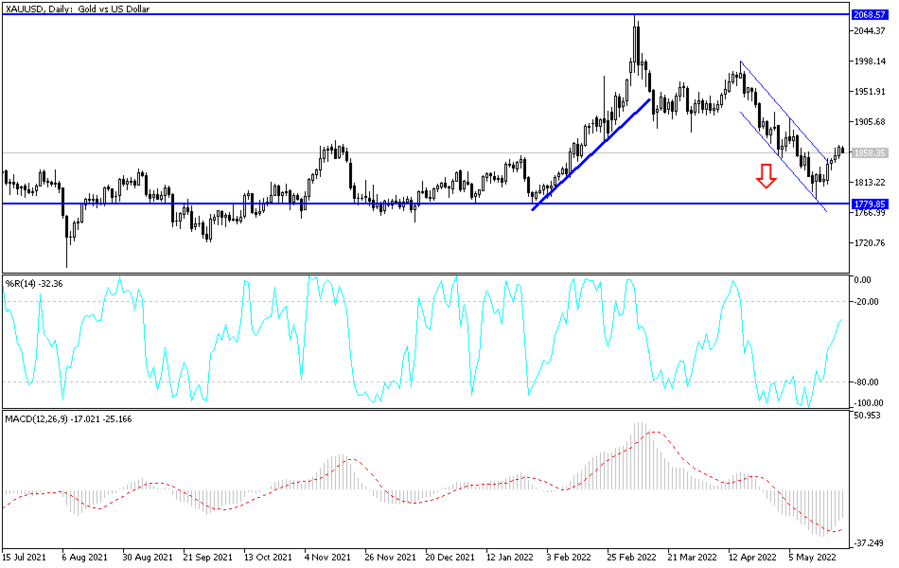

According to gold technical analysis: On the daily chart below, the price of gold is still in the phase of exiting the bearish channel and moving towards the resistance levels of 1878 and the psychological top of 1900 dollars. This will confirm the stronger control of the bulls on the trend. In general, I still prefer buying gold from every descending level, despite the tendency of global central banks to tighten their monetary policy, which is negative for gold. It finds momentum from other factors, most notably the continuation of the Russian-Ukrainian war and the persistence of the epidemic in the negative impact on the second largest economy in the world.

The closest support levels for gold are currently 1848, 1832 and 1820 dollars, respectively. The gold market will be affected today by the reaction of the US dollar to the announcement of the contents of the minutes of the last meeting of the US Federal Reserve.

[ad_2]