[ad_1]

Today’s recommendation on the lira against the dollar

– Risk 0.50%.

None of the buy or sell trades of our recommendation was activated yesterday

Best entry points buy

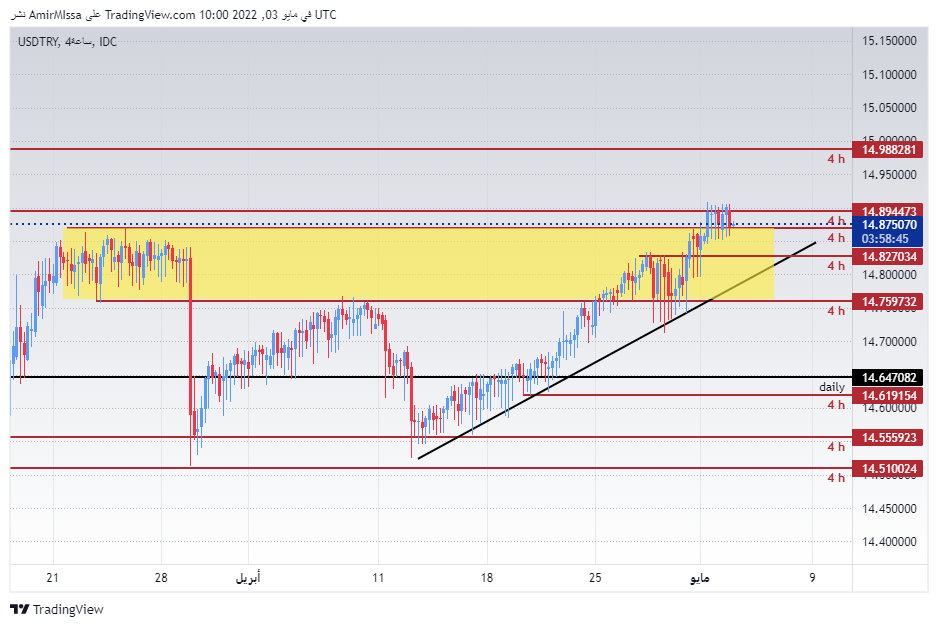

Entering a long position with a pending order from 14.62 مستويات levels

– Set a stop-loss point to close the lowest support level 14.46.

– Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

Entering a short position with a pending order from 14.99 . levels

– The best points for setting the stop loss are closing the highest levels of 14.98.

– Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira rose slightly, although it is still within a limited range, as investors followed the statements of the Turkish Finance Minister, Nureddin Nabati, who said that his country will provide inflation-linked bonds soon. The Turkish government is seeking to provide multiple means to increase foreign exchange in the country to stop the loss of the lira against the dollar over the past years, especially since 2018. It is reported that the lira has lost about 40 percent of its value at the end of last year only. The lira is expected to decline, especially with the Federal Reserve heading to increase the interest rate during this month’s meeting, and during the upcoming meetings. The high inflation rate in the country also contributed to putting pressure on the price of the lira, as inflation in Turkey reached more than 60 percent, the highest level over the past 20 years.

On the technical front, the Turkish lira rose slightly against the dollar during today’s trading, as the lira is still trading in the highest demand areas shown on the chart. The pair also rose around the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. At the same time, the pair is based on the ascending trend line shown on the chart with continued trading within a limited trading range. The pair is trading the highest support levels, which are concentrated at 14.82 and 14.74 levels, respectively. On the other hand, the lira is trading below the resistance levels at 14.99. We expect the lira to continue to decline, especially if the pair closed above the resistance levels of 14.91. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]