[ad_1]

The GBP/USD exchange rate rose to a one-month high above 1.22 last week, but the direction could become more difficult in the coming days as it navigates a minefield of US economic data risks just as the shadow of the Bank of England (BoE) looms. Dollars were sold off again last week and almost universally, enabling the pound to partially reverse the significant mounting losses it had incurred since the early days of June when US inflation data put the Federal Reserve on course for a 1.5% rate hike in just two months.

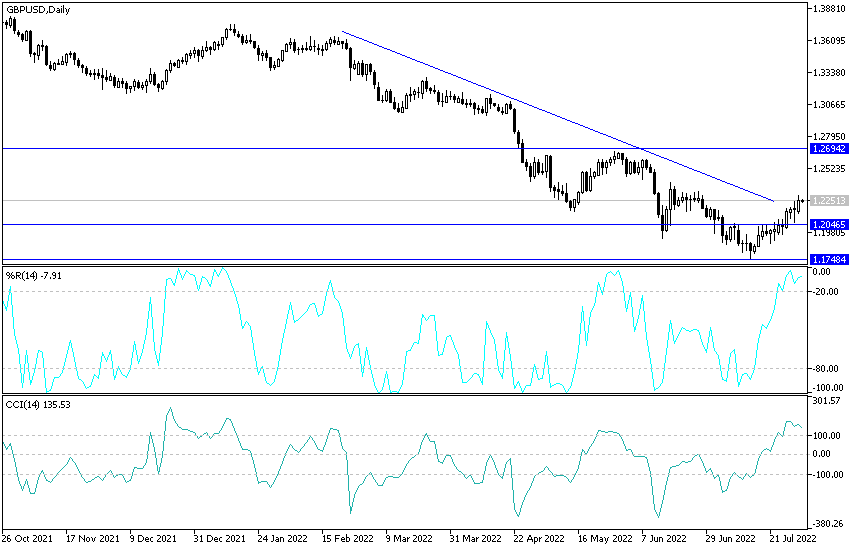

The GBP/USD pair succeeded in testing the resistance 1.2293 at the beginning of this week’s trading, before settling around the 1.2250 level at the time of writing the analysis.

The British pound got off to a strong start last week in a follow-up response to data released late the previous Friday, which left the dollar struggling after noting that the all-important US service sector contracted in July, but later rose significantly after the Fed decision last Wednesday.

Commenting on the performance, Michael Cahill, forex analyst at Goldman Sachs said, “As we noted last week, the FOMC made an important policy change by adjusting its policy guidance and expanding criteria for slowing the pace of future interest rate hikes to more explicitly include activity expectations.” He added, “The market has correctly assessed this as a peaceful outcome under the current circumstances, in our view. The decision will have to be seen in conjunction with the latest wage and inflation data, which will make it difficult for the market to press hard on the pessimistic narrative.”

The GBP/USD price had risen by more than 160 points to recover the 1.21 resistance and approached 1.22 after the Federal Reserve provided a second increase in the US interest rate in a row by 0.75% to 2.5%, but it also confirmed that the size of future increases will be dependent on the coming of Economic data releases.

Where is GBP/USD headed?

It rose further when lower inventories at general retailers and auto dealers combined with lower business investment and government spending plotted to lead the US economy into a second consecutive quarter of negative growth and a so-called technical slump. The rally was halted briefly on Friday after the core PCE price index and the employment cost index showed higher inflation and wage costs more than unanimously envisaged during July in results that could have implications for US Fed policy in September.

It remains to be seen whether the recovery of the pound against the dollar can be extended further during the early days of this week. What is certain is that the action-packed US economic calendar and the Bank of England interest rate decision on Thursday have the potential to catalyze a setback for the pound. “We think the BoE will conclude that inflationary pressures are now more persistent and will raise interest rates by 50 basis points, from 1.25% to 1.75%,” says Nicholas Farr, UK economist at Capital Economics. We believe interest rates will rise to a peak of 3.00% in the first half of next year.”

There is a great deal of uncertainty as to whether the Bank of England will raise the bank rate by a typical quarter of a percentage point – to 1.5% – or whether it will choose one of the larger half-percentage point increases that have been popular recently elsewhere in the world and will require it.

Some analysts and economists expect the BoE to stick with the usual 0.25% increase including that of HSBC which was said to sell the pound last week for exactly this reason, although the price of the pound will face plenty of other risks before and after Thursday’s decision.

There are at least two members of the Federal Reserve’s rate-setting committee who are due to speak publicly this week and comments from either of them could have positive effects on the dollar on markets’ assumptions about interest rates from September onwards, which were revised downward last week.

The Institute for Supply Management’s (ISM) PMI surveys on Monday and Wednesday also pose risks in both directions for the GBP/USD pair with markets likely to look to see if it confirms the bleak message of the S&P Global surveys, and so too with US farm payrolls report for July.

Sterling dollar forecast:

According to the performance on the daily chart, the recent gains of the GBP/USD pair moved some technical indicators towards oversold levels. We see that the currency pair is on its way to profit-taking operations more than expecting more gains. Markets have already priced in the Bank of England’s rate hike this week and have internalized it happening. At the same time, the most important interest will be the US jobs numbers by the end of the week. Currently, the nearest resistance levels for the sterling pair are 1.2320 and 1.2400, respectively.

On the other hand, and over the same time period, the movement of the sterling dollar towards the support levels 1.2165 and 1.2050 will be important for the bears’ return to control the trend and the end of the current bullish outlook.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]