[ad_1]

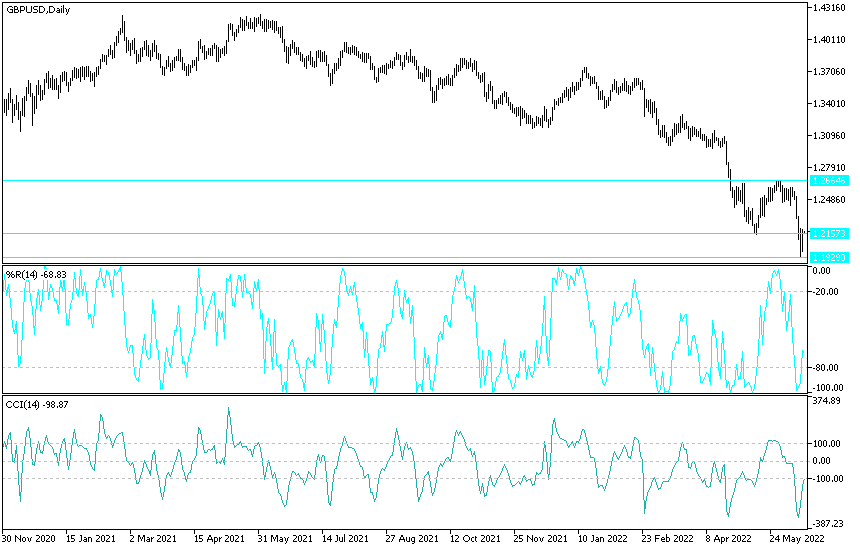

The British pound may be on the way to recover against the US dollar if the Federal Reserve eases market expectations. Indeed, after the announcement, the price of the GBP/USD currency pair recovered to the level of 1.2204, a rebound from the recent collapse, which moved on its impact towards the 1.1933 support level, its lowest for a few years and settles around the 1.2170 level at the time of writing the analysis. Investors are counting on the Bank of England’s announcement today to look for catalysts for the pound in the forex market.

The Fed raised interest rates by 75 basis points, but according to analysts at Western Union Business Solutions, expectations about the scale of the Fed’s post-June hikes are starting to look excessive. As money markets show almost certainty that 75 points of gains will be delivered, “it should be noted that given the current aggressive market pricing, there is a risk that the Fed will fail to deliver on its expected hawkishness.”

If the market revises expectations of how much further interest rates will rise, by lowering the expected final interest rate (essentially the peak rate expected in 2023), the dollar could give up some of its recent gains. Some analysts say this could allow GBP/USD to extend its so far tepid recovery from 28-month lows.

The call comes on the heels of the pound to the dollar dropping below 1.20 to test a low of 1.1934 on Tuesday.

Overall, the GBP/USD exchange rate is still stuck in a specific downtrend and any strong bounces may be short as the trend extends. According to some experts, “the pound sterling is licking its wounds after falling to its lowest level in 13 months against the euro and its lowest level in 28 months against the US dollar. There are still many headwinds, such as higher UK inflation, lower economic growth expectations compared to its major counterparts, slowing price expectations, and also a harsh injection of more political anxiety.”

FX analysts point to a number of headwinds facing sterling, including ongoing tensions between the European Union and the United Kingdom over the Northern Ireland protocol and the unveiling of a new Scottish independence scheme by Nicola Sturgeon.

The biggest risk event for the British currency in the near term comes in the form of the Bank of England’s meeting on Thursday as it considers the next move on interest rates. Markets are currently expecting a 25bp hike but see a high potential for a material 50bp increase in light of the aggressive stance of the Fed and the UK’s ongoing battle against 9.0% inflation in April.

While a more decisive 50 basis point rally could help investor sentiment toward the British pound, it is likely to remain disappointing. According to some currency analysts, “The last time the GBP/USD fell below $1.20, the currency pair slipped all the way to $1.14 (albeit for a short time). All eyes are on the weekly close to provide the next trend signal, but given how much the GBP has fallen recently, selling cannot rule out a term recovery. The Fed and Bank of England meetings will play a critical role in determining the course of the sterling-dollar.”

According to the technical analysis of the pair: The reaction from the Bank of England’s announcement today, along with the results of the US economic data and the path of global stock markets, will have a strong and direct reaction to the performance of the GBP/USD pair. The strongest bears’ control, and according to the performance on the daily chart below, stability below the support 1.2155 will support the stronger bearish move below the psychological support 1.2000, and have completed the path of the collapse.

On the upside, it will be important to break the 1.2330 and 1.2500 resistance levels for the first exit from the current downtrend.

[ad_2]