[ad_1]

The USD/JPY pair may maintain its bullish momentum until the release of US inflation figures by the end of the week.

The free collapse of the Japanese yen in the forex market led by the USD/JPY currency pair towards its highest in 20 years led all other currencies to achieve record gains. The currency pair jumped to the resistance level 133.00 before settling around the 132.50 level at the time of writing the analysis. The clear contrast in the future of raising interest rates during 2022 was in favor of the record US dollar gains and the collapse of the Japanese yen, as Japan is still providing more stimulus to the Japanese economy. There is a clear disregard there in the issue of raising interest rates, as do the rest of the other global central banks led by the US Federal Reserve.

All too often, a currency collapse is a sign of deep economic distress – like the euro swoon in 2014 or the pound crashing after the Brexit vote in 2016. For Japan in 2022, some see it as the best chance for recovery. The yen fell to a two-decade low against the dollar, caught in the crossfire between the two sharply different monetary policy regimes in Japan and the United States. The Bank of Japan is suspending interest rates at zero in an attempt to boost the faltering economy and stimulate price growth, while the Federal Reserve is raising rates sharply to fend off rampant inflation.

As a result, the higher yields available in the US are pushing the dollar higher and leaving the yen to collapse. 3% on benchmark Treasuries versus just 0.25% in Japan.

The turning point of inflation in Japan has approached with the price hike. However, the reaction of top Japanese policy makers to the renewed weakness of the yen on Tuesday indicates that they also see a positive side. This is because cost-push inflation driving a weaker yen is likely to offer Japan its best chance of securing stable inflation in years. Bank of Japan Governor Haruhiko Kuroda told parliament he wanted to build on the momentum to create a “benign cycle in which prices rise moderately while corporate profits, employment and wages improve.” Overall, a weak currency hurts households and importers, but boosts overseas profits for Japan’s biggest global names. Ultimately, the cheaper yen will also help restore the once thriving tourism industry that was a major driver of their regional economies.

“The cheaper yen is negative for household budgets, but looking at the Japanese economy as a whole, its positive impact is greater,” said Masamichi Adachi, an economist at UBS Securities. Chief Cabinet Secretary Hirokazu Matsuno said the Japanese yen has good as well as bad repercussions for the economy, as he reiterated the government’s view that it is watching foreign exchange markets with a sense of urgency.

His comments, and the recent language used by senior Japanese officials, sounded less frank than the warnings issued by the Finance Ministry at the end of April. That was when the BoJ doubled down on its easy monetary policy as yields threatened to rise above the allowable level and the yen saw a faster pace of decline. After more than a month to get used to sharply lower yen levels – as low as 133 per dollar – on Tuesday and to assess the potential difficulty of successfully intervening to support the currency, the government appears ready to sit down now.

Harumi Taguchi, chief economist at S&P Global Market Intelligence, said, “The rhetoric has not solidified on the yen’s decline this time around. This is partly because the economy is improving. After virus restrictions are lifted, consumption rebounds and wages make moderate gains. However, I do not think that everything will turn out like the perceptions of the Bank of Japan. Consumers have become sensitive to higher prices and if this continues for a while, it will affect household spending.”

The health of the world’s third largest economy is at stake.

Policy makers can help launch the much-needed growth engine in Asia. If I get it wrong, they risk a disorderly crash in one of the major currencies which could prompt the Bank of Japan to adjust policy immediately, and Japan plunges into another recession.

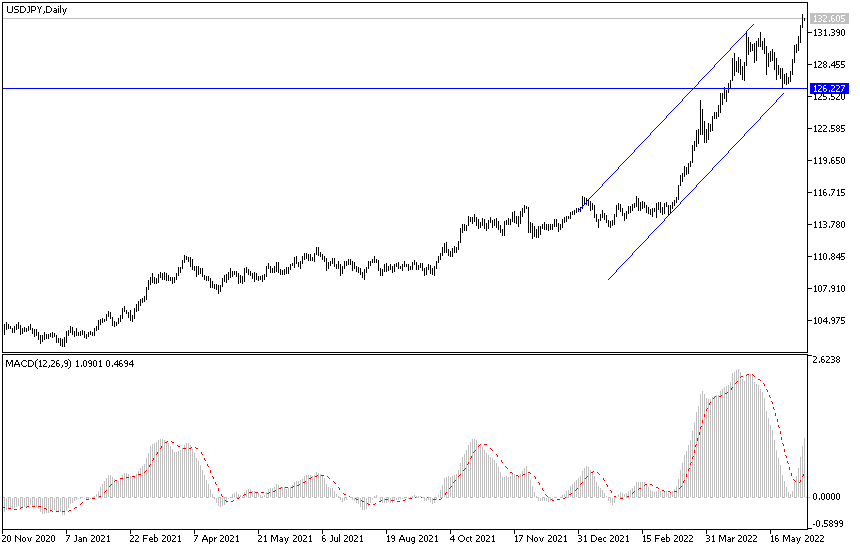

According to the technical analysis of the pair: The general upward trend of the USD/JPY currency pair is getting stronger. Its recent gains have moved some technical indicators towards overbought levels, taking into account that the continuation of its gains may support the move towards new record high levels. The closest resistances for the currency pair are currently 133.20 And at 134.00, it is necessary to be careful not to activate selling operations to take profits at any time.

The USD/JPY pair may maintain its bullish momentum until the release of US inflation figures by the end of the week.

[ad_2]