[ad_1]

The markets continue to be very noisy, especially as we have seen so much in the way of concern with the economy, the war, and inflation.

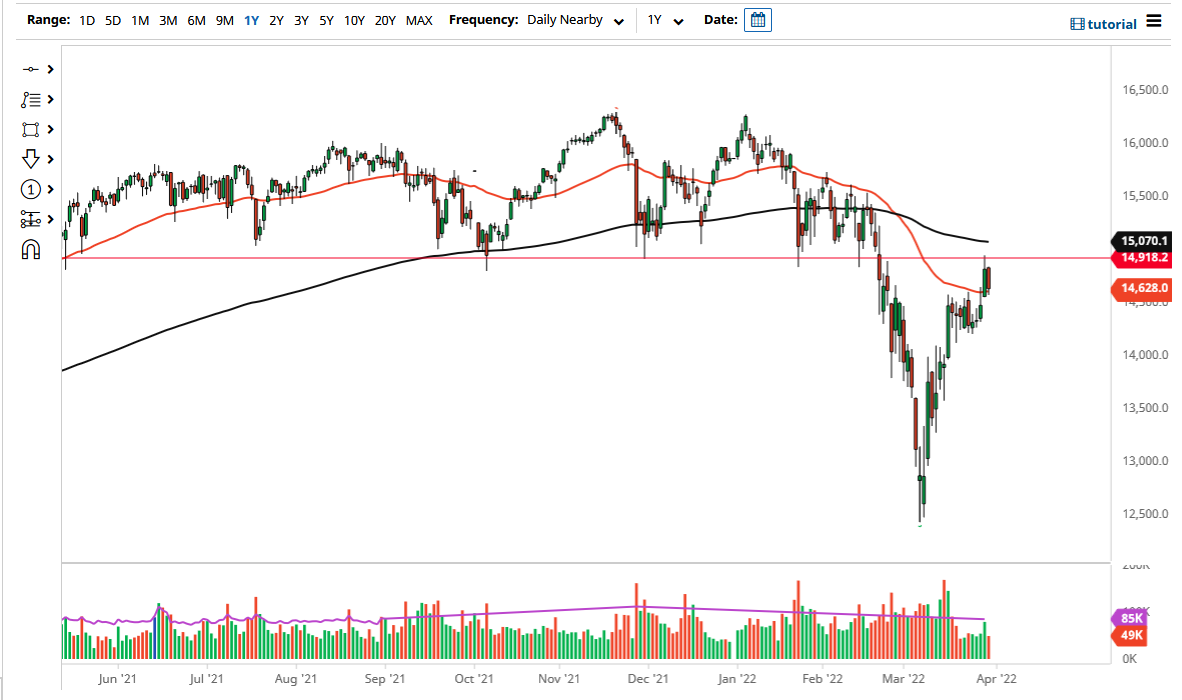

The German index has pulled back a bit during the trading session on Wednesday to reach the 50 Day EMA again. This is an area that we had broken through during the previous session, so now we need to determine whether or not this is a simple pullback and retest it, or if it is the market acknowledging the area around the €14,900 level as significant resistance?

The DAX has broken higher over the last couple of days, and this suggests that perhaps a bullish flag has just kicked off. However, we need to get above the 200 Day EMA to confirm this. We are in an area that has a lot of noise, to say the least, and therefore I think you will probably get more of a sideways choppy action out of the market than anything else. If we were to break down below the €14,250 level, then the market more likely than not will unwind completely. It does look as if the market is going to continue to see a lot of volatility but given enough time it is possible that we see a decisive move. I believe that the next couple of days will give us an idea as to where we are going long term.

Keep in mind that the DAX has been a bit overextended, but we also recently had a bit of consolidation, which suggests that we may have worked off some of the froth. All stock markets that I follow right now I have been extraordinarily overdone in the short term, but that does not mean that they can continue higher given enough time. The candlestick from the trading session on Wednesday wiped out all of the gains from Tuesday, so waiting to see where we go next is the best way forward.

The market is currently sitting between the 50 Day EMA and the 200 Day EMA, which typically leads to some type of squeeze. It is all lining up for a bigger move, and now we need to see which direction we break. The markets continue to be very noisy, especially as we have seen so much in the way of concern with the economy, the war, and inflation. Just during the Wednesday session, estimates of GDP and Germany were taken down quite drastically.

[ad_2]