[ad_1]

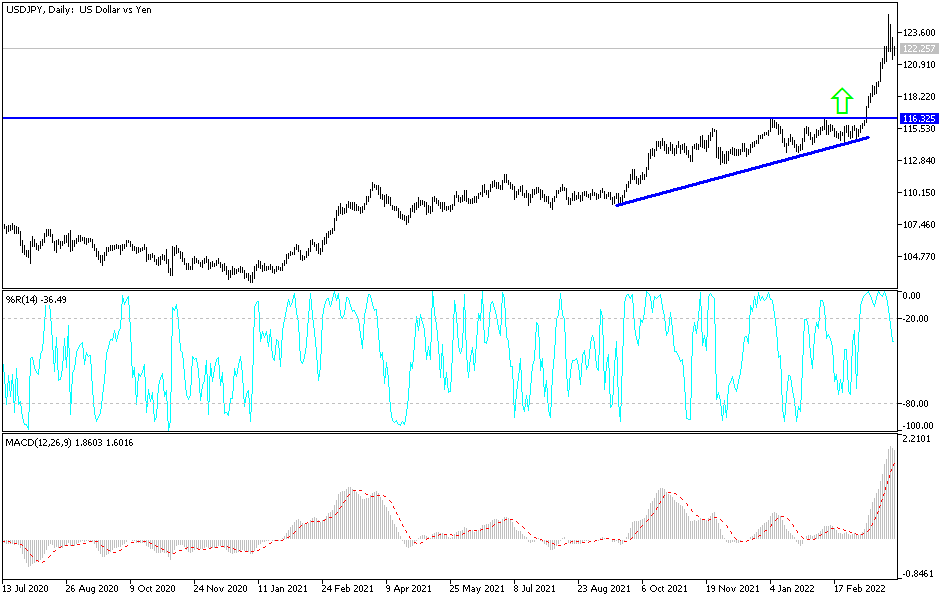

For the third day in a row, the price of the USD/JPY currency pair is still subjected to profit-taking operations after its recent gains, reaching the resistance level of 125.10, the highest in seven years. The recent selling operations pushed it to the correction towards the 121.30 level, which is stable near it at the time of writing the analysis. I have often noted in the technical analyzes of the currency pair that the recent gains pushed the technical indicators towards strong overbought levels, and profit-taking may occur at any time.

The Japanese yen’s recent plunge has caught the attention of Japanese government and central bank officials. Bank of Japan Governor Haruhiko Kuroda gave another strong indication that the Bank of Japan will continue to cap long-term bond yields after holding its first meeting with Prime Minister Fumio Kishida since touching the yen. Kuroda met the Prime Minister after another morning of violent moves by the Bank of Japan to maintain a cap on the 10-year yields that were hovering near the central bank’s upper limit at around 0.25%.

The Bank of Japan surprised investors by pledging to buy more securities than planned earlier Wednesday and to include long-term debt on a day when global bonds rebounded. The bank is already in the middle of an unprecedented three-day buying campaign to defend the 10-year yield.

The yen had already risen against the dollar as prospects of an escalation of the war in Ukraine reinforced expectations that upward pressure on commodity prices and global inflation would abate. Despite Kuroda’s comments, market speculation about the possibility of a government request on monetary policy is likely to continue. BoJ watchers say Kishida’s view will be a major factor in determining the direction of monetary policy this year. The meeting comes after Kishida on Tuesday ordered measures to cushion the impact of higher energy prices, which have been amplified by a weaker yen, as he looks to keep popular support buoyed ahead of the summer elections.

According to the technical analysis of the pair: After the recent selling operations, the bears will succeed in gaining more control over the performance of the USD/JPY currency pair. If it moves below the psychological support 120.00, the real shift and the trend to the downside will need to move towards the level of support at 118.50. At the moment, the closest targets for the bulls are 122.40 and 123.60, respectively.

I still prefer selling the dollar yen from every rising level, which will be affected today by a package of US economic data, most notably the personal consumption expenditures price index reading, the Federal Reserve’s preferred measure for measuring US inflation. In addition, the number of weekly unemployed claims.

[ad_2]