[ad_1]

I think the only thing we can count on now is going to be a lot of noisy behavior, so you need to be cautious about your position sizing.

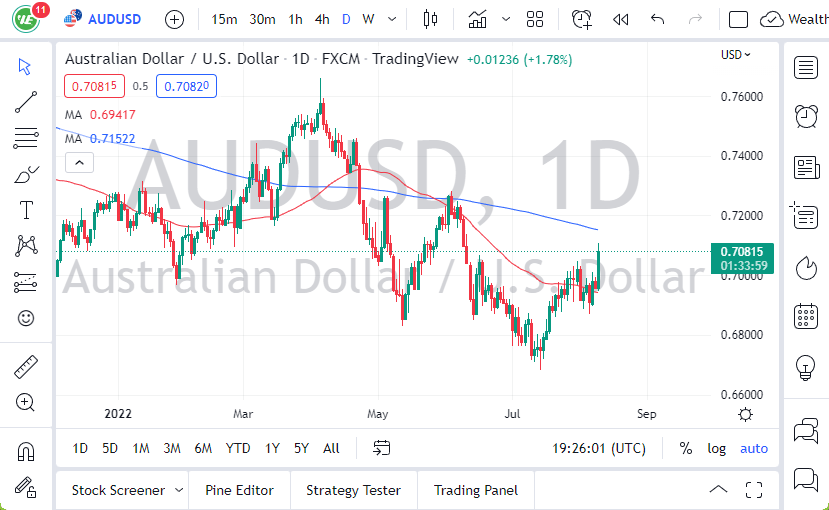

- The AUD/USD currency pair rallied significantly on Wednesday as the CPI number came out much cooler than anticipated.

- Because of this, the idea is that the Federal Reserve can start to pivot a bit, but it’s very unlikely to happen. After all, inflation is 3 ½ times what the Federal Reserve looks for, so they are going to continue to be very tight.

Strong Candlestick

The size of the candlestick is very strong, and it does suggest that we have a little further to go. At this point, the market looks as if it is going to threaten the 200-day EMA, as it is now below the 0.72 level and grinding lower. I think that could be a bit of difficulty trying to hang onto, and I think it’s probably only going to offer a lot of trouble. Signs of exhaustion will get sold into, due to the fact that the US dollar continues to be highly sought after in general, especially as we have a major recession ahead of us.

If we do break above the 0.72 level, then possibly we could see this move all the way to the upside. At that point, we could see the 0.76 level. I just don’t see that happening though, and it’s likely that the market is going to run into exhaustion before we get there. If we break down below the 50-day EMA, that opens up the possibility of a drive down to the 0.69 level, which has been supported previously. Breaking below there opens up the possibility of a move to the 0.67 handle. That’s an area where we have been multiple times over the longer term, and it has offered a massive amount of support. Breaking below that level could open up a massive selloff and what would be a very negative turn of events for risk appetite overall.

I think the only thing we can count on now is going to be a lot of noisy behavior, so you need to be cautious about your position sizing. That’s probably sage advice for just about any market right now, but the Aussie does tend to be very noisy, so that makes quite a bit of sense. The US dollar seems to be trying to recover against the euro and the British pound, so we will see what happens here.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]