[ad_1]

Volatility is the only thing you can count on, but I do believe that it is more likely than not going to be a situation where selling is going to be easier.

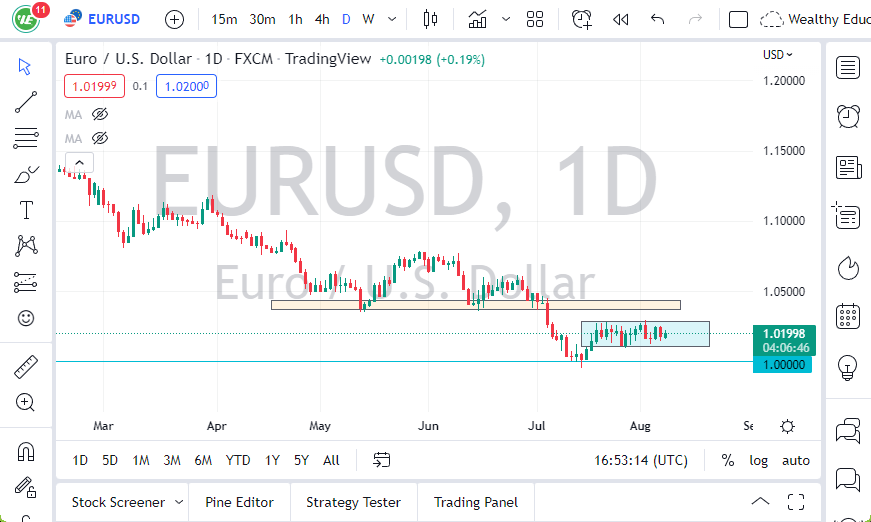

If you ever wanted to fall asleep trading, you can do so by watching the euro. This of course is being said half tongue-in-cheek, but the reality is that we have nowhere to be at the moment. The market continues to hang about between the 1.01 level underneath, and the 1.03 level above. This is a market that is probably better traded from the short term than anything else.

Pay Attention to Support and Resistance

If you are a short-term trader, you can probably go back and forth on a 15 minute chart until we finally break out. Even if we break out, I think at this point you need to pay attention to some areas just above and below the market right now as well. After all, the 1.04 level is massive resistance, as it was previous support. The 50-day EMA sits in the same area as well. On the other hand, if the market were to break down from here, it could open up the possibility of retesting the 1.00 level.

The 1.00 level is obviously an area that a lot of people will pay close attention to, as it has a lot of psychology attached to it. If we were to break down below the parity level, then a lot of money will flow into this market, sending a massive amount of money into this market, especially if we get a daily close below the parity level. At that point, I anticipate that the market could go down to the 0.98 level, possibly even the 0.96 level.

It’s not until we break above the 1.06 level that I would consider that we could have a little bit of momentum, opening up the possibility of the market rally into the 200-day EMA. Ultimately, this is a market that I think is going to be noisier than anything else, especially as the European Union has a major issue when it comes to energy and its economy in general. Quite frankly, I think the euro is in serious trouble, and it is probably only a matter of time before we break down. Volatility is the only thing you can count on, but I do believe that it is more likely than not going to be a situation where selling is going to be easier.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]