[ad_1]

Get our trading strategies with our monthly & weekly forecast of currency pairs worth watching using support & resistance for the week of August 8, 2022.

This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching. The first part of my forecast is based upon my research of the past 20 years of Forex prices, which show that the following methodologies have all produced profitable results:

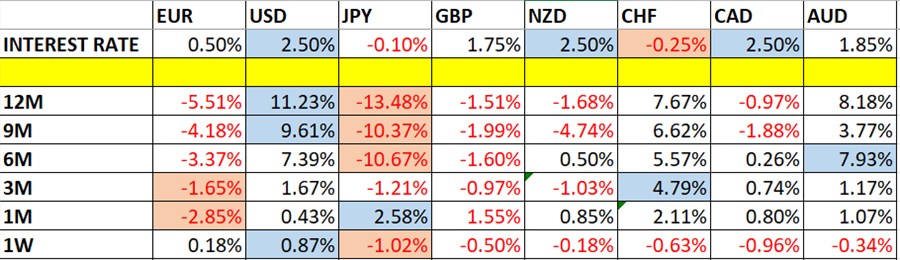

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Currency Price Changes and Interest Rates

Monthly Forecast August 2022

For the month of July, I forecasted that the EUR/USD currency pair and the GBP/USD currency pair would both decline in value. The result was nicely profitable:

|

Currency Pair |

Forecasted Direction |

Interest Rate Differential |

Final Performance |

|

EUR/USD |

Short ↓ |

+1.75% (1.75% – 0.00%) |

+2.46% |

|

GBP/USD |

Short ↓ |

+1.25% (1.75% – 0.00%) |

+0.04% |

Monthly Forex Forecast Performance

For the month of August, I forecast that the EUR/USD currency pair will decline in value.

Weekly Forecast 7th August 2022

I make no weekly forecast as last week saw no major counter-trend price movements over the week.

The Forex market saw a low level of directional volatility last week, with only 11% of all the important currency pairs or crosses moving by more than 1% in value. Directional volatility is likely to increase over this coming week as there will be a release of very crucial US CPI data on Wednesday. However, it is worth noting that we are well into the month of August, which typically sees low levels and volatility and activity in the Forex market anway.

Last week was dominated by relative strength in the US Dollar, and relative weakness in the Japanese Yen.

You can trade my forecasts in a real or demo Forex brokerage account.

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

|

Currency Pair |

Key Support / Resistance Levels |

|

AUD/USD |

Support: 0.6878, 0.6797, 0.6784, 0.6719Resistance: 0.6999, 0.7063, 0.7141, 0.7213 |

|

EUR/USD |

Support: 1.0073, 1.0042, 0.9950, 0.9900Resistance: 1.0210, 1.0250, 1.0300, 1.0350 |

|

GBP/USD |

Support: 1.1958, 1.1926, 1.878, 1.1864Resistance: 1.2078, 1.2193, 1.2241, 1.2338 |

|

USD/JPY |

Support: 134.92, 134.55, 133.48, 132.41Resistance: 135.32, 135.82, 136.59, 137.40 |

|

AUD/JPY |

Support: 93.24, 91.88, 91.53, 90.58Resistance: 94.20, 95.00, 95.23, 95.54 |

|

EUR/JPY |

Support: 136.56, 135.72, 134.97, 134.03 Resistance: 137.78, 138.07, 138.53, 140.22 |

|

USD/CAD |

Support: 1.2924, 1.2903, 1.2880, 1.2818Resistance: 1.2974, 1.3046, 1.3090, 1.3179 |

|

USD/CHF |

Support: 0.9574. 0.9534, 0.9498, 0.9438Resistance: 0.9663, 0.9722, 0.9749, 0.9813 |

Key Support and Resistance Levels

Ready to trade our Forex weekly analysis? We have shortlisted the best Forex trading brokers in the industry for you.

[ad_2]