[ad_1]

Ultimately, volatility will continue, but I still favor the greenback.

- The AUD/USD currency pair was slammed Tuesday, being the first currency to start losing ground against the US dollar.

- This was followed by the Japanese yen, euro, and the British pound as well.

- Yields in America started to rise, and that means that the demand for the US dollar started to pick up as well.

AUD/USD Technical Analysis

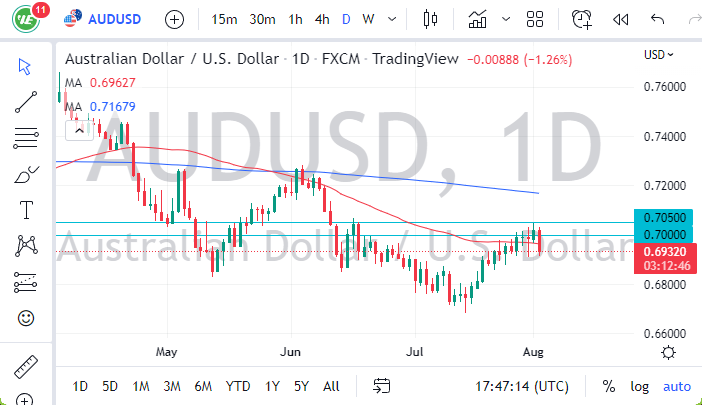

The Australian dollar has broken through the 50-day EMA, and now is threatening to break down below the 0.69 level. If it can break down below the 0.69 level, it’s likely that the Aussie will go looking to the 0.68 level initially, perhaps even down to the 0.67 handle, an area that is crucial. In fact, the 0.67 level being broken to the downside would be a major turn of events, perhaps opening up a bit of a “trapdoor” against the Aussie dollar.

Keep in mind that the Australian dollar is highly sensitive to China and commodity markets. There has been a lot of noise about Nancy Pelosi going to Taipei during the session, that of course had people freak out as well. That being said, I don’t know if that’s reason enough to think that this market continues lower. At this point, I’m simply willing to look at the fact that we have been in a downtrend for a while, and momentum is to the downside still. As rates start to rise, that only adds more pressure to US dollar buying, which course has a bit of a knock-on effect here. Ultimately, it’s also worth noting that the market failed right at the 50 PIP range that I had talked about previously. The 0.70 level is the beginning of that area, and we even managed to touch the 0.7050 level during the trading session on Monday, showing that it was a perfect pullback.

The candlestick size for the Tuesday session is rather varied, but it’s not till we break down below the 0.69 level that I would be convinced that we are ready to go lower. If we do not, then it’s likely that we spend a lot of time going sideways over the next couple of days as we await the jobs number on Friday, which of course is a major catalyst for the markets in its own right. Ultimately, volatility will continue, but I still favor the greenback.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]