[ad_1]

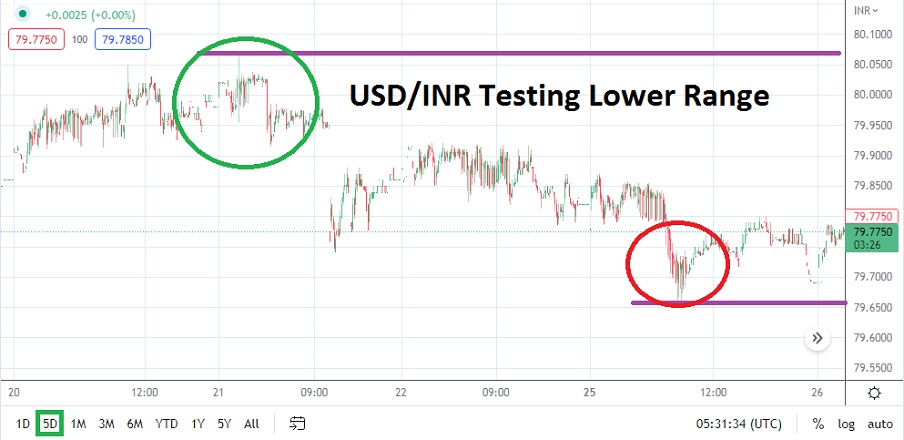

The USD/INR is trading within the lower realms of its range having produced short term volatility, as speculators await a volley of important factors in the coming days.

As of this writing the USD/INR pair is near the 79.7700 mark as values change with the blink of any eye. Early this morning the USD/INR currency pair swiftly traded to lows and a ratio around the price of 79.6900 was momentarily seen. The spike lower quickly reversed higher and did teach speculators one tough lesson which is known by experienced traders of the USD/INR: opening spikes to start the day are dangerous and can flush out standing orders.

The rupee has been extremely popular lately – don’t miss these interesting opportunities!

Trade Now

Spike Lower and Reversal Higher as USD/INR again searches for Equilibrium

The upwards lift from early morning lows attained a high of nearly 77.7870 today. The fact that a dip to near term lows was seen may be a technical sign for some traders that erosion of value in the USD/INR is about to occur, but it should be remembered why the currency pair is within record high territory. The U.S Fed is very hawkish and international economic conditions have combined to create a USD that continues to demonstrate strength against many major currencies, including the Indian Rupee.

More Monetary Policy from U.S Federal Reserve will affect the USD/INR Currency Pair

On the 21st of July the USD/INR did trade above the 80.0000 for a sustained day. Yes, the USD/INR has come off of these apex highs, but they are still within sight and likely not forgotten. The coming U.S interest rate hike on Wednesday has already been factored into the market; a hike of 0.75% is expected from the Federal Reserve. However, volatility before and after this announcement from the U.S central bank is certain to be displayed and traders need to be aware of the coming fluctuations which will be dangerous.

- Interest rate hike from U.S central bank of 0.75% has already been factored into the USD/INR, but further volatility will be produced.

- Thursday and Friday economic data could prove potentially more dangerous for USD/INR than the U.S Fed’s pronouncements via GDP data and inflation numbers.

Conservative traders should be careful over the next few days. While the USD/INR has certainly started to move within the lower elements of its short term price range, from a risk reward perspective there may be more room to explore upwards in the coming days from a volatility perspective. Speculators need to use stop loss orders to protect against sudden spikes lower, but wagering on upside developing again may prove worthwhile.

Yes, the USD/INR is bound to start eroding in value at some point and change its bullish trend into a bearish movement, but knowing exactly when that is going to take place remains difficult. In the meantime, looking for reversals higher when support is tested and proves durable could remain the best wager for the USD/INR.

USD/INR Short-Term Outlook

Current Resistance: 79.8040

Current Support: 79.7520

High Target: 79.8890

Low Target: 79.6780

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]