[ad_1]

After strong gains at the beginning of this week’s trading, reaching the resistance level of 1.2045, the price of the GBP/USD currency pair retraced yesterday to the level of 1.1924 and settled around the level of 1.1985 at the time of writing the analysis. As I mentioned before, the sterling dollar gains will remain a target for selling as the factors of the US dollar’s strength continue. Britain’s inflation could peak at 12% in October according to a number of new economic forecasts made following Wednesday’s release of inflation data for June which showed that UK consumer prices are already rising at the fastest pace in 40 years.

“We now expect UK CPI inflation to peak at around 12% in October,” says Andrew Goodwin, chief UK economist at Oxford Economics.

This, and a host of other updated forecasts, underscores BoE Governor Andrew Bailey’s new determination to accelerate the bank’s battle against accelerating rates. As such, Oxford Economics expects UK inflation to remain significantly higher in 2023, reflecting a combination of higher energy futures prices, higher oil refinery margins likely to keep UK gasoline prices elevated, and a weaker pound.

Independent research consultancy Ofgem estimates it will raise the energy price cap by 60% to £3,135 in October – well above the 40% increase that Ofgem estimated. And with more pain on consumers and businesses, they expect an additional £340 hike in January. NIESR says they now expect annual CPI inflation to peak near 11% at the end of 2022/beginning of 2023, due to the rise in the energy price ceiling, and to remain above target until 2023.

UK Inflation Remains Higher

UK inflation hit 9.4% on an annual basis in June as the Office for National Statistics said on Wednesday, a figure hotter than market expectations of 9.3% and up 9.1% in May. This was after prices rose 0.8% in the month ending June, ahead of the 0.7% that markets had expected and the 0.7% rise in the month ending May. Core CPI – which excludes external factors such as fuel – rose 5.8% on an annual basis, in line with expectations and touching less than 5.9% in May.

The data also showed that price hikes were widespread and not necessarily limited to capacity increases, an observation that increases pressure on the Bank of England to overcome rising inflation expectations among workers and businesses. Accordingly, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, says the headline rate of CPI inflation now looks set to rise to nearly 12% in October. He stated, “The further rise in wholesale electricity and natural gas prices over the past month indicates that Ofgem will increase the default tariff ceiling by 65% in October. This indicates that the contribution of energy to the main rate of CPI inflation will rise to 6.0 in October, from 3.4 points in June, provided that oil prices remain at their current level.”

The Bank of England, on the occasion of its June policy update, said it was now ready to take “strong” steps to raise interest rates. Investors interpreted this as suggesting that the bank would give up its 25 basis point gains for a larger 50 basis point increase in August. In a speech at Mansion House on Tuesday, Bank of England Governor Bailey said, “A 50 basis point increase will be among the options on the table when we next meet.”

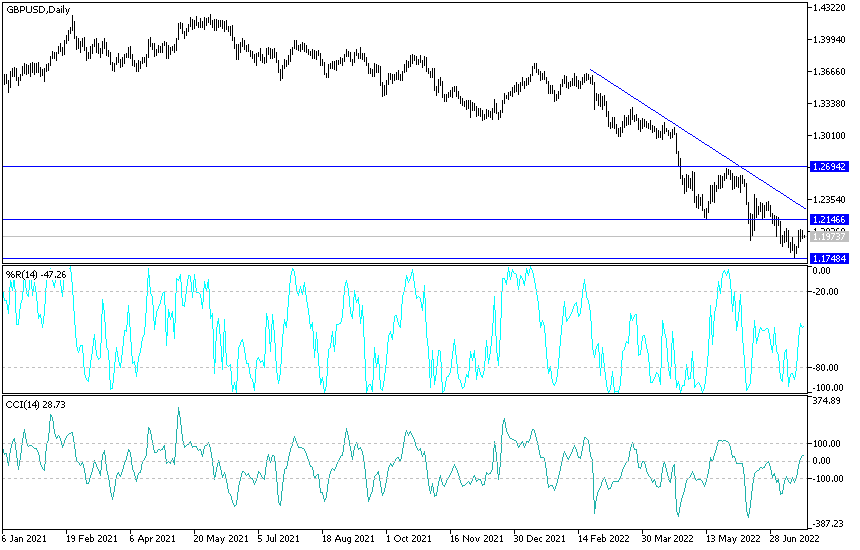

GBP/USD Technical Outlook:

So far, according to the performance on the daily chart, the GBP/USD currency pair has failed to penetrate the most prominent downside trend of the currency pair’s performance. The breach may occur only if the bulls move in the currency pair towards the resistance levels 1.2190 and 1.2420, respectively. I still prefer selling sterling dollars from every bullish level. On the other hand, stability below the psychological support 1.2000 will support the bears for more downward movement. The currency pair will be affected by investor sentiment after the European Central Bank announcement and the opportunity for Russian gas to return to Europe again or not.

[ad_2]