[ad_1]

The European Central Bank appears ready to start its interest rate raising cycle with a bold 50 basis point increase, according to recent statements from some of the bank’s monetary policy officials. Therefore, the euro strengthened against the dollar and the rest of the other major currencies. This came after ECB member Martins Kazak said that it is worth looking at a 50 basis point rise in July, even if a 25 basis point move is still the default. However, the EUR/USD pair failed to maintain the rebound gains towards the 1.0605 resistance, as it retreated to the 1.0503 support level and settled around it at the time of writing the analysis.

The official added to Bloomberg TV that if the ECB raises the interest rate by 25 basis points in July, a 50 basis point move will be needed in September. “If we see that the situation has worsened and that inflation is high and we see negative news in terms of inflation expectations, then in my view, preloading an increase would be a reasonable option,” Kazak added.

Viraj Patel, an analyst at Vanda Research, says a 50 basis point rise in July “will happen. The ECB has a small window to make the spikes…hawks know it’s ‘a moment of now or never’. Any EZ CPI that wins this week will push the ECB to do 50 basis points in July.”

Overall, the euro-dollar exchange rate has already risen by a third of a percent this week amid improved global market sentiment and expectations that the European Central Bank will begin to bridge the interest rate gap that exists between it and the US Federal Reserve with a number of rate increases.

“The market should not deviate from the speed of repricing and jump to much higher interest rate levels,” Kazak said in June. But the hint of a 50bp move in July suggests it may be tempted to bring the ECB’s deposit rate back to 0% quickly. This will be a busy week for ECB interest rate policy as central bankers descend on Sintra, Portugal for the ECB’s annual meeting.

However, it can be argued that the FX markets will be more interested in how the European Central Bank handles the issue of maintaining a lid on Italian and Greek bond yields as interest rates rise. This is part of the “fragmentation” argument: some eurozone countries are in a better financial position than others and will inevitably see the yield they pay on their debt (bonds) rise faster.

This could destabilize the Euro-Zone and thus represents a major risk to the Euro outlook. However, the European Central Bank said it has the tools to ensure that the difference in bond yields between different countries remains stable, thus containing risks.

Reuters quoted sources in the European Central Bank as saying that there is a plan in the near future that will see the European Central Bank continue to buy bonds of weak countries, which would put a cap on the return paid by these bonds, and thus put a cap on borrowing costs. But to offset this stimulus, the ECB will drain liquidity from elsewhere in the system, potentially offering banks attractive interest rates for the ECB’s cash stalemate according to Reuters.

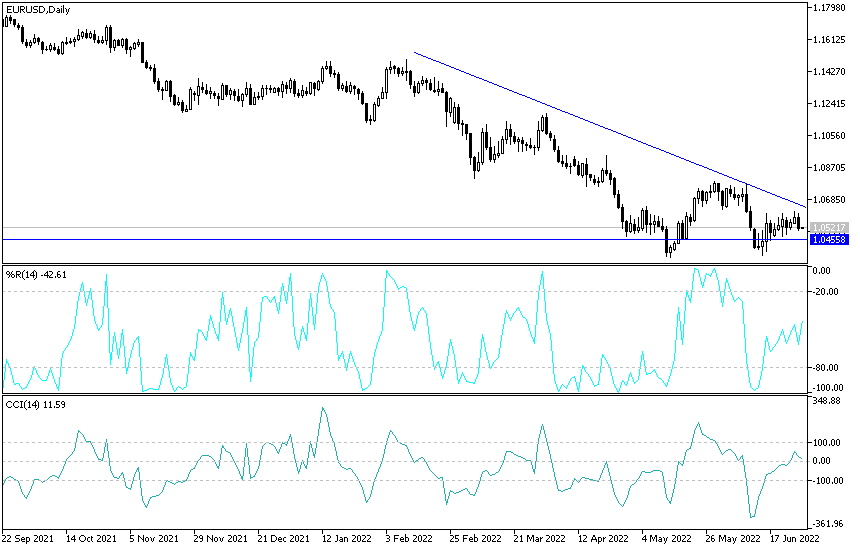

EUR/USD analysis today:

As I mentioned before, the breach of the 1.0500 support level will remain important for a stronger and continuous control of the bears over the price performance of the EUR/USD currency pair. Accordingly, the following support levels may be 1.0425 and 1.0380, which will move the technical indicators towards strong oversold levels through which one may think about Buy back EURUSD. On the other hand, breaking the resistance levels 1.0670 and 1.0800 is important to start breaking the current general bearish trend. The euro-dollar pair will react to the announcement of the growth rate of the US economy and the statements of Fed officials, Powell, and ECB Governor Lagarde.

[ad_2]