[ad_1]

The hopes of euro investors quickly evaporated in the recent hawkish statements from European Central Bank officials headed by Lagarde about the approaching date for raising the ECB interest rate 11 years ago. The EUR/USD currency pair tumbled from the resistance level 1.0773 to the support level 1.0506 and is stabilizing around the level 1.0515 at the beginning of this important week’s trading. We indicated when the euro’s recent gains will not last long because the US Federal Reserve will be the fastest and strongest in raising interest rates than the European Central.

Currently, traders are seeking the European Central Bank’s support to smash bonds with the approach of price hikes. Markets are not convinced that the European Central Bank can raise interest rates and maintain bond yields for the most indebted eurozone members at the same time. Italy, one of the countries most exposed to rising borrowing costs, saw its 10-year debt drop after the biggest drop since the pandemic, as European Central Bank President Christine Lagarde outlined plans last Thursday to raise interest rates for the first time in more than a decade.

Meanwhile, the spread on German bonds approached towards levels that recently prompted the European Central Bank to start buying sovereign debt in an effort to stabilize the currency bloc as Covid-19 swept the continent in March 2020.

Investors are concerned about the lack of a credible plan to tackle so-called fragmentation – unjustified jumps in borrowing costs for weaker eurozone countries compared to stronger economies. Some say that only the new instrument, separate from previous bond-buying programs, can contain the spreads. Commenting on this, Nicholas Forrest, head of global fixed income at Candriam, a $180 billion asset manager, said: “This is an ‘whatever it takes’ moment for Lagarde. He was referring to a speech by former European Central Bank President Mario Draghi, who pledged to ensure the safety of the eurozone at all costs as the sovereign debt crisis erupted in 2012.

Meanwhile, Forrest is particularly cautious about Italian and Spanish debt given the volatility and potential for increased bond issuance from those countries. “The European Central Bank will need to avoid policy mistakes,” he said.

Global central banks face an unstable equilibrium process as they seek to combat rising prices without disrupting business activity. The situation in the eurozone is unique, with 19 disparate economies whose fiscal policies are not aligned. The fear is that without a plan, excessive widening of spreads could divert the ECB from its mission to combat inflation, forcing it to halt or even begin to reverse the rate-raising cycle.

What has so far been earmarked for retail processing – reinvestment from maturing debt accrued under the European Central Bank’s pandemic asset purchase program – is widely seen as insufficient. Programs like the outright cash transactions, which Draghi created during the last crisis, still exist, but are seen as too inflexible to be appropriate now.

A new machine is in the works as Bloomberg reported in April. Details are still scarce. Some analysts believe that spreads of around 250 basis points could prompt the European Central Bank to intervene, even if only by disclosing the instrument. We are not at those levels yet. The German-Italian bond spread is at 225bp – far from the 500bp gap seen in the worst days of Europe’s sovereign debt crisis.

But the uncertainty weakened the euro, erasing gains after Lagarde offered only vague reassurance that “if needed in the future we can design, we can deploy the right tool”.

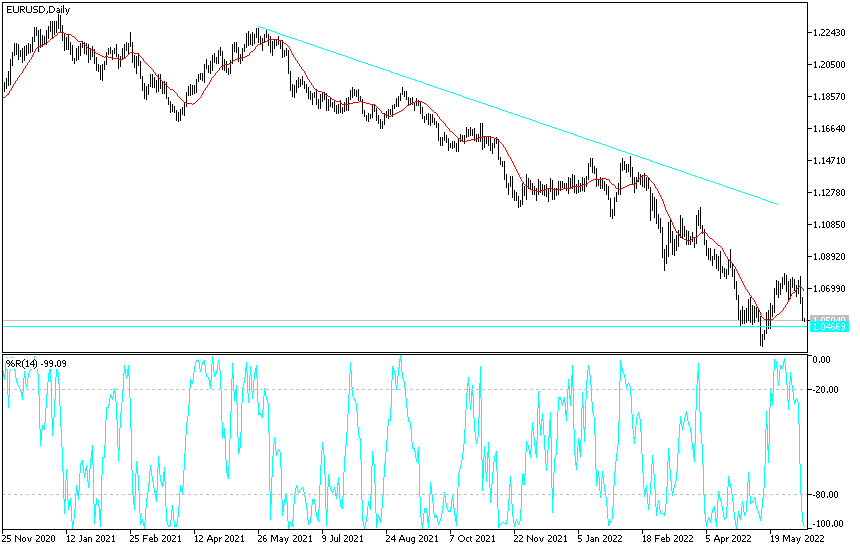

According to the technical analysis of the pair: On the daily chart, the price of the euro currency pair against the dollar EUR/USD is moving towards the support level 1.0500. This which will support the bears’ control of the trend and prepare to move towards the stronger support levels that are closest to it. This is according to the performance over the time period 1.0460 and 1.03800, respectively, as the last level is support for the move of technical indicators towards oversold levels, from which a resumption of buying can be considered.

It must be considered that this week’s events are important and affect the forex market in general, and the US Central Bank’s announcement on Wednesday is the most influential, and the movement may remain in narrow ranges until this date. On the upside, the bulls should return to the vicinity of the 1.0795 and 1.1000 resistance levels, otherwise the general trend will remain bearish.

[ad_2]