[ad_1]

Since the start of this week’s trading, the price of the EUR/USD currency pair has been in a cautious wait until an update to the European Central Bank’s policy is announced. In addition we are also waiting for the US inflation numbers that will be announced on Friday. These events will chart the course of the currency pair’s movements in the coming days.

Ahead of these events, the price of the euro against the dollar EUR/USD is settling around the 1.0740 level. The markets are looking forward to the approaching date of the last interest rate hike from the European Central Bank. Bank of America warns that the European Central Bank will raise its key deposit rate well above 0% before the year ends, but this risks increasing retail risks in the eurozone.

In a new research note, Bank of America says it now expects a cumulative 150 basis points of a rate hike this year, 50 basis points more than their previous assumptions. They see big moves of 50 basis points in July and September, which is more optimistic than the market consensus which is currently anticipating a more cautious 25 basis point move in July.

Commenting on this, Ruben Segura Caiwela, Europe economist at Bank of America Europe in Madrid, says: “Our call was already more hawkish than the consensus, it is even more powerful now.” “We cannot see the ECB avoid moving 50 basis points by September at the latest.” Such a surprise could boost the euro’s exchange rates initially, but “we remain concerned that this is too fast”, and in fact, the team of economists at Bank of America describes themselves as “conflicting a hawkish call for the European Central Bank” came in a recent note comes days before the European Central Bank’s June policy update, scheduled for Thursday.

The policy update should see the ECB confirm ending its quantitative easing program with the first rate hike confirmed in July. But a rush to tackle inflation could mean the risks of a eurozone fragmentation rise rapidly, “with Italy in the spotlight”.

“To be absolutely clear, we still don’t understand the ECB’s impulse,” the analyst added. We consider ourselves total bears, because we don’t really understand how the economy can go through a very large energy price shock unscathed in the first place, never mind how the economy is supposed to handle neutral rates when it is so far out of equilibrium. Hence, we expect the economy to stop the central bank after all these hikes this year.”

However, the logic of various members of the European Central Bank’s Governing Council has recently been adopted by Bank of America, including President Christine Lagarde. The ECB has made it clear that it wants to be seen as acting against inflation and to be proactive against the risks of second round effects. Eurozone inflation was 8.1% in May 2022, up from 7.4% in April 2022.

Bank of America is concerned that raising interest rates quickly would put undue upward pressure on the so-called peripheral eurozone countries such as Greece and Italy. They are already paying more than countries like Germany and France on their sovereign debt, and higher interest rates from the European Central Bank will inevitably increase their financing costs.

The danger is that the rising costs of financing for these countries become disorganized and trigger a new crisis.

Moreover, the analyst says that markets are not thinking enough about the prospects of a recession in the eurozone, and “we have the impression that recession risks are more easily recognized in the US than in the eurozone.”

What is the solution to the headache facing the eurozone economy?

More financial support is the solution suggested by Segura Caiwela. “Headwinds are coming from all sides, and fiscal policy, at the moment, is doing very little to offset.” Accordingly, Bank of America suggests a more cautious approach to fiscal policy tools could prevail, in anticipation of higher financing costs on the back of monetary tightening. Meanwhile, a shift in the economic landscape will cause the European Central Bank to rein in its ambition to raise interest rates in 2023.

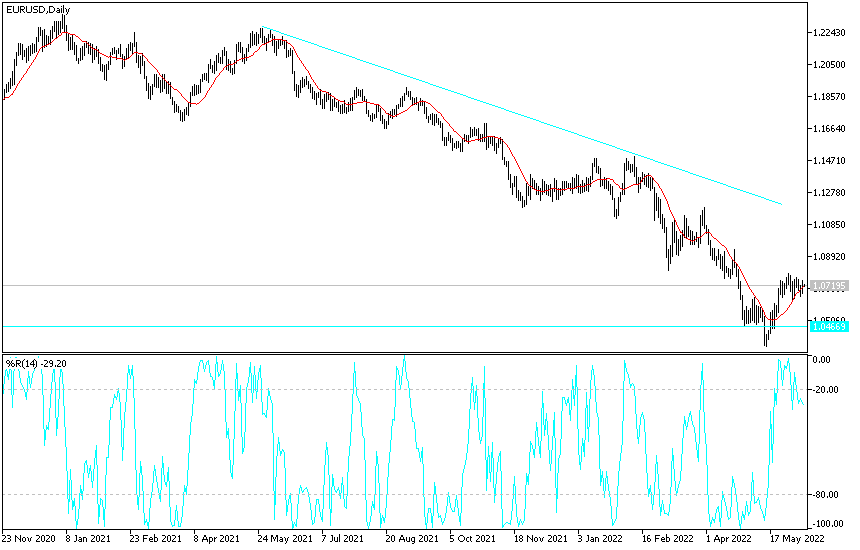

According to the technical analysis of the pair: We expect unstable movements for the EUR/USD currency pair today, pending the announcement of the European Central Bank’s policy update. We are especially focusing on the tone of his statement and the statements of ECB Governor Lagarde. Any indications of a strong policy tightening path will support more gains for the euro against the dollar, and the closest to them will be 1.0785 and 1.0880, and the last level is important to expect the psychological resistance 1.1000, respectively.

In the event of caution to tighten the bank’s policy, it will give the US dollar the opportunity to launch, and thus breaking the 1.0630 support will push the bears to move strongly downward, as is the case with the general trend of the currency pair.

[ad_2]