[ad_1]

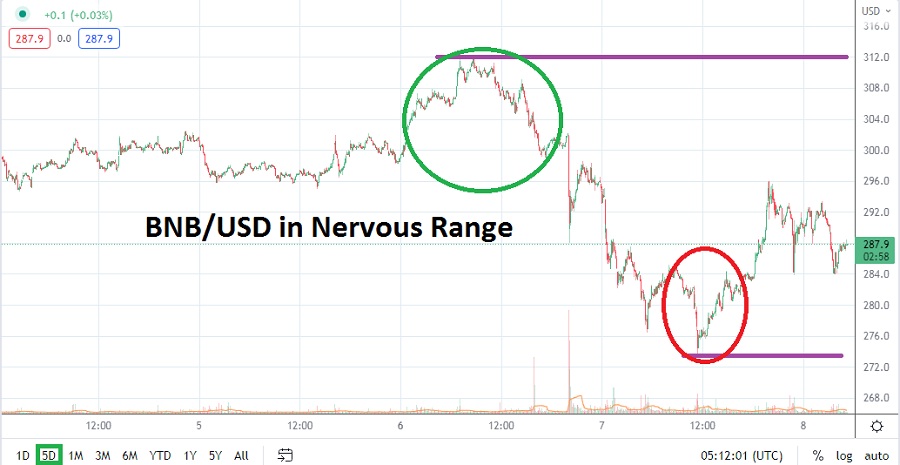

BNB/USD has slumped in price the past day and a half, as nervous speculators and legal shadows loom over Binance.

BNB/USD is trading near the 287.0000 mark as of this morning, on the 6th of June Binance climbed to a high of nearly 312.0000. However, the broad cryptocurrency market remains fragile, and also creating potential headwinds among speculators are legal shadows which hover over Binance as regulators ask questions regarding the company’s business practices.

After falling below the 300.0000 level on Monday, BNB/USD did show price velocity downwards. Yesterday’s prices action in BNB/USD did mirror the major cryptocurrencies and reversals higher have been accomplished in limited fashion this morning after hitting a low of nearly 283.0000 a few hours ago. This ratio should now be watched as support by day traders.

The 300.0000 level remains a natural target for speculative bullish investors, but buyers may be in short supply near term for BNB/USD. Traders are encouraged to keep their expectations realistic if they seek upwards movement in the short term. Digital assets including BNB/USD remain within sight of important support levels.

While Bitcoin and Ethereum did escape the clutches of their lower depths yesterday, there still does not seem to be a sparkling climb upwards that is about to be generated. The long term bearish trend remains intact. Traders who believe Binance Coin is oversold are free to have their opinions and in the long term may be proven correct, but speculators seem to lack confidence and there appears to be a shortage of overwhelmingly strong bullish buyers who can turnaround the trend.

If support levels are aimed for in the short term this may prove to be a worthwhile wager, but traders should anticipate choppy conditions to linger. However, if the 283.0000 ratio were to fail and prices below start to be flirted with another wave of selling could ignite rather quickly.

Yesterday’s low price for BNB/USD was near 274.0000 and another test of this level is certainly not out of the question near term. From a risk reward technical perspective combined with the fragile state of the cryptocurrency market, it would appear that BNB/USD has a greater chance to see greater volatility downwards compared to upwards momentum.

Potential bulls looking for upside price action should be careful and use tight take profit targets which aim for existing resistance levels. A move above the 290.0000 would be a good first step for BNB/USD with a higher goal of 296.0000 perhaps too optimistic. If BNB/USD is not able to topple the 290.0000 mark in the short term, it may be a signal that consolidation is going to generate another move lower.

Binance Coin Short Term Outlook:

Current Resistance: 290.1000

Current Support: 284.6000

High Target: 303.9000

Low Target: 261.0000

[ad_2]