[ad_1]

Start the week of June 6, 2022 with our Forex forecast focusing on major currency pairs here.

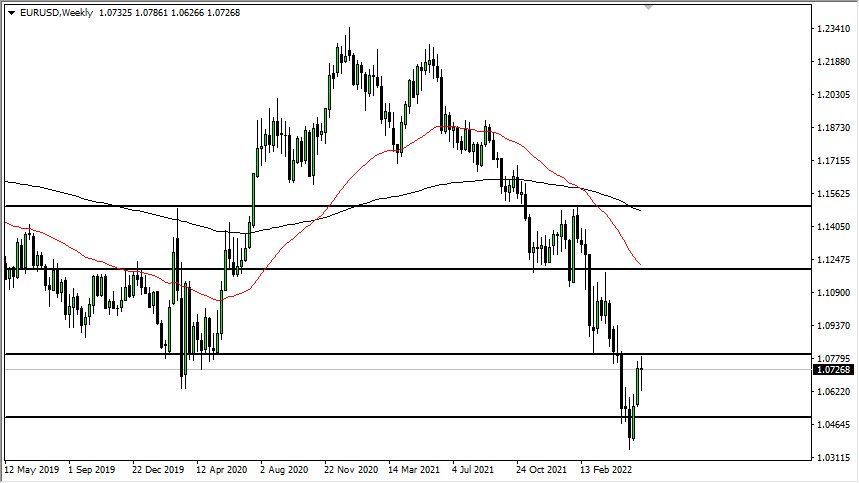

EUR/USD

The Euro has had a very volatile way, ending up unchanged. Because of this, the market looks as if it is going to continue seeing a lot of noisy behavior, as we are trying to figure out whether or not interest rates in America will continue to climb. On Friday, they did but abated shortly after the initial shock of the jobs report. At this point, the 1.08 level could open up a move to the 1.09 level, which at that point breaking above that would switch me to bullish. More likely than not, we get sideways action with more of the downward pressure.

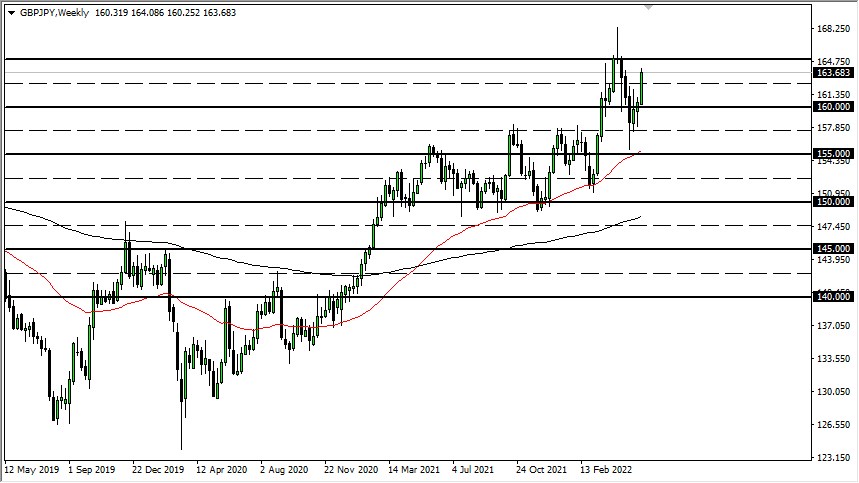

GBP/JPY

The British pound has shot straight up in the air during the trading week as it looks like we are reaching higher due to the Bank of Japan’s quantitative easing. The ¥165 level will be the target, the market had rallied so much during the week that a short-term pullback would be expected. At this point though, it’s obvious that the buyers have come back into the market to push to the upside. Given enough time, if only believe that we will test that ¥165 level again. The ¥160 level is massive support, assuming that we can even fall that far.

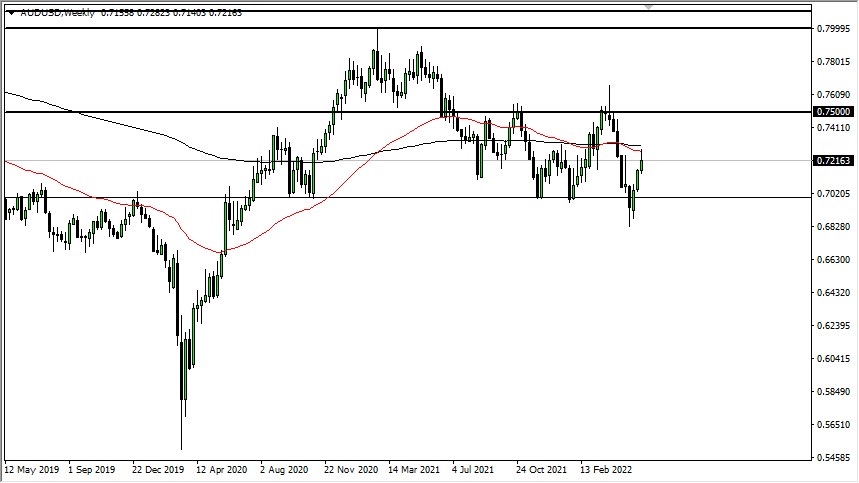

AUD/USD

The Australian dollar has shot higher during most of the way but struggled late as we started to see a little bit of a pullback from the highs. At this point, it looks as if the rally is starting to run out of steam, and now the overall malaise could come back into the picture. This will be especially true if interest rates continue to climb in the United States, and people worry about the reopening trade which the Aussie dollar is heavily levered to. During this week I anticipate selling rallies showing signs of exhaustion unless we break above the 0.7350 level.

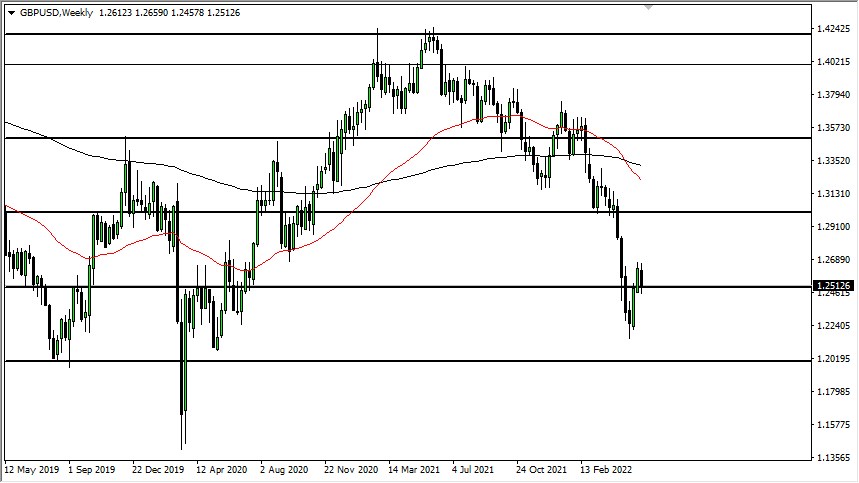

GBP/USD

The British pound has fallen during most of the week but found a little bit of support just below the 1.25 level. It is worth noting that Friday was very bearish after the jobs number, and interest rates started to rise in America again. If that continues to be the case, I suspect that a breakdown below the bottom of the candlestick for this week could open up selling down to the 1.22 level. Rallies are to be sold until we can break significantly above the highs of the last two weeks.

[ad_2]