[ad_1]

Ultimately, this is a market that is going to be very noisy, so you need to be very cautious about your position sizing and risk management overall.

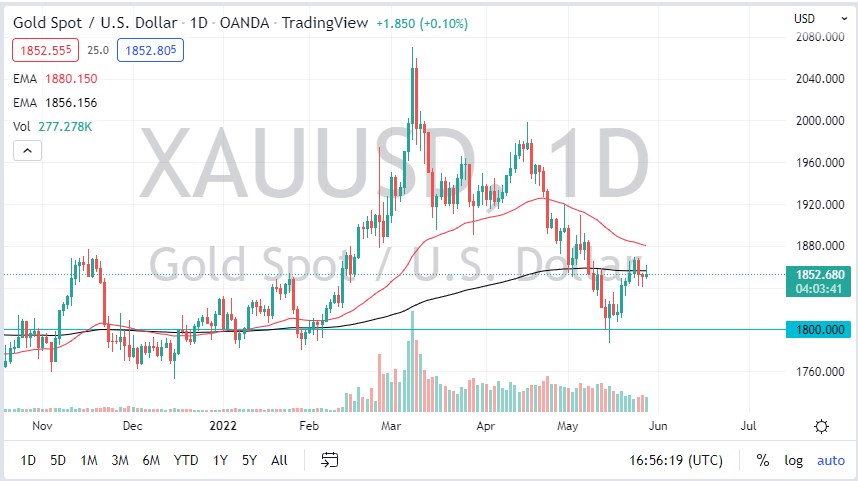

The gold market rallied during the early hours on Friday but gave back gains quite significantly. At this point, the market is dancing around the 200-day EMA, suggesting that the markets are trying to figure out where we’re going next. As the 200-day EMA is so widely followed, this is going to be an interesting place to watch the market.

Forming a hammer that is followed by a shooting star suggests that the market is looking for some type of momentum. If we can break above the highs of the shooting star for the Friday session, that would be very bullish, just as a breakdown below the bottom of the hammer would be an extraordinarily bearish turn of events. In that scenario, we would more likely than not drop toward the $1825 level, maybe even the $1800 level. It is at the $1800 level that we are trying to figure out whether or not we can form a bottom or at least stabilize enough to continue to attempt a move to the upside.

Alternatively, if we break to the upside is likely that the market will go looking to reach the 50-day EMA, and then possibly even the $1900 level. The $1900 level will be an area of interest as it is not only a large, round, psychologically significant figure, but it is also an area where we had seen support previously so a certain amount of “market memory” would be expected in that neighborhood. Breaking above there allows gold to go much higher, perhaps reaching the $2000 level.

The gold market will pay close attention to the bond market because as yields spiked previously, it put a lot of downward pressure on gold. Now that we are starting to see buyers step in and buy bonds, it has been driving yields down. If the yields continue to drop, that could be a reason for gold to rally. Furthermore, we have a lot of geopolitical issues out there that could continue to have people running toward safety, and of course, inflation to say the least. Ultimately, this is a market that is going to be very noisy, so you need to be very cautious about your position sizing and risk management overall.

[ad_2]