[ad_1]

As far as a longer move is concerned, it will not be until we break out of this channel.

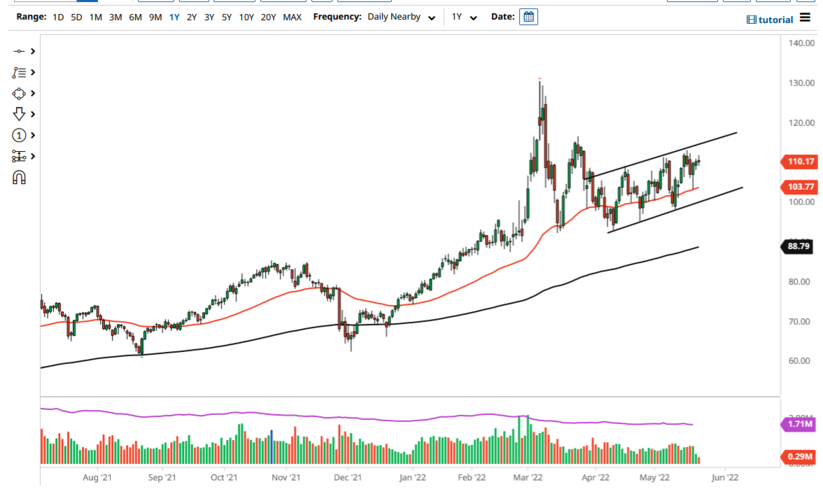

The West Texas Intermediate Crude Oil market rallied a bit on Monday but turned around and fell to show signs of hesitation. Because of this, the market is more likely than not going to continue to be noisy and choppy, to say the least. Because of this, I think you need to pay close attention to the overall channel that we have been in.

The up-trending channel has been in effect since the middle of spring, and therefore it will have a lot of market memory attached to it. The 50-day EMA sits underneath the $103.77 level and is rising, which extends support all the way down to the uptrend line. This is a market that has a lot of questions asked of itself, not the least of which would be whether or not there is going to be demand going forward. Ultimately, this is a market that has to worry about a slowing down of the global economy, and the possibility of a recession. In a recessionary environment, it would make a lot of sense that demand for crude would drop.

On the other hand, if we were to break above the $115 level, then we could go looking to the $120 level above. The $120 level then would allow a potential move to the $130 level. The $130 level is where we stalled previously, so a return to that level would make a certain amount of sense. Ultimately, you need to keep an eye on the barriers that we have been trading in, and then whether or not there is a global appetite for risk out there. Keep in mind that crude oil is a risk-based market, so you need to pay attention to whether or not people are trying to price in those types of trades.

When you look at this chart, you can see that we have been grinding back and forth but with a bit of a significant upward trajectory. Because of this, the market is one that I will be looking to buy on dips more than anything else. However, you will probably have to look at the short-term charts in order to find entries and exits. As far as a longer move is concerned, it will not be until we break out of this channel.

[ad_2]