[ad_1]

GBP/USD has rebounded sharply from two-year lows after a positive turn in UK economic data and a rebound in Chinese renminbi sold heavily. This could lift it further this week and could test technical resistance near 1.2662 on the charts.

At the beginning of this week’s trading, the sterling dollar pair moved towards the 1.2600 level, before settling around the 1.2575 level at the time of writing the analysis.

The currency pair’s recent gains came from a level of more than 1.22 last week and after the cacophony of supportive domestic and international developments, including the more favorable British economic data and the decline of the US dollar. Overall, stronger-than-expected first-quarter wage growth in Britain, strong April retail sales numbers, and a temporary drop in all-important US government bond yields all designed or otherwise supported a higher positive shift in the US-UK yield spread.

The rebound in the GBP/USD rate may also be supported by the sharp rebound in the renminbi exchange rates given how both currencies were affected in April when the Chinese currency weakened in response to the now easing “shutdown” in the world’s largest port city, Shanghai. Some support measures for the Chinese economy and some stability in the Chinese renminbi helped usher in a period of consolidation in the forex markets. This may continue this week, although we consider this a pause rather than a reversal of the dollar’s bullish trend. Shanghai began a phased reopening of the “lockdown” last week, which could see China’s foreign trade and manufacturing activities return to normal in June, while the People’s Bank of China (PBoC) cut mortgage interest rates in order to support the local economy.

To the extent that this puts the renminbi on a firmer footing this week, it is also likely to push the pound against the dollar even more given that sterling has had one of the strongest correlations with the renminbi in recent months and has fallen more than the dollar. Chinese currency during the weeks following Shanghai’s April 05 “lockdown”. For illustrative purposes, the analyst’s own calculations suggest that if the renminbi were to recoup a third of the losses it incurred in that period, the British pound and the euro would likely reverse nearly half of their declines from the same period.

Any such scenario could see the USD/CAD drop to 6.67 while the GBP/USD and EUR/USD reverse upwards towards 1.2662 and 1.0670 respectively, although the problem for all these currency pairs is that they are still facing risks associated with the Federal Reserve and US interest rate policy.

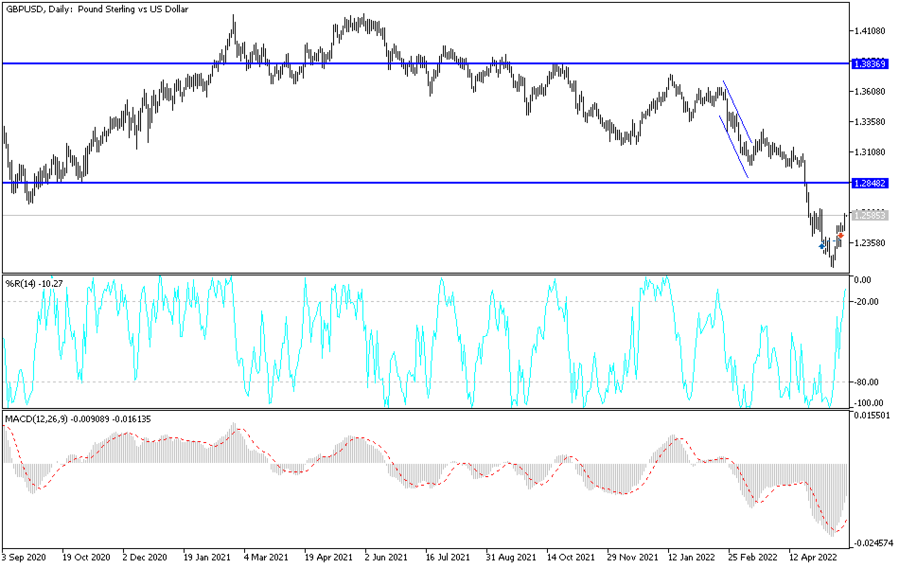

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair is still at the beginning of the exit from the bearish channel. The real shift in the trend will not occur without the bulls moving towards the 1.2850 resistance levels and the psychological top 1.3000. Otherwise, the general trend will remain bearish, bears control will get stronger if the currency pair returns to the 1.2380 support level. I still prefer to sell the GBP/USD pair from every bullish level.

The currency pair will interact today with the announcement of the PMI readings for the manufacturing and services sectors for both Britain and the United States of America.

[ad_2]