[ad_1]

Despite US Federal Reserve Governor Jerome Powell’s emphasis on the Fed’s determination to keep raising US interest rates until there is clear evidence that inflation is steadily declining – a high-risk effort that carries the risk of eventually causing a recession – the USD/JPY was sold off. The pair reached the level of 128.00, near which it is stable at the beginning of trading today, Thursday.

The yen is a popular asset during turbulent times.

The Fed’s increases in its benchmark short-term rate, in turn, usually raise borrowing costs for consumers and businesses, including mortgages, auto loans and credit cards. “What we need to see is inflation coming down in a clear and convincing way,” Powell said in remarks to the Wall Street Journal conference. “And we’ll keep pushing until we see that.”

The US central bank governor, who was confirmed by the Senate last week for a second four-year term, has suggested that the Fed will consider raising interest rates faster if rate increases fail to moderate. “What we need to see is clear and convincing evidence that inflation pressures are easing and inflation is declining,” Powell said. And if we don’t see that, we’ll have to think about moving more aggressively. And if we see that, we can consider moving to a slower pace. ”

He added that the Fed would “not hesitate” to push the benchmark interest rate to a point that would slow the economy if necessary. While it’s unclear what the level might be, Fed officials hold it at around 2.5% to 3%, roughly three times its current position.

Powell’s comments on Tuesday followed others he made that indicated the Fed is carrying out a series of rate hikes that could amount to the fastest credit tightening in more than 30 years. At a meeting earlier this month, the Federal Reserve raised its key US interest rate by half a point – double the usual increase – for the first time since 2000, to a range of 0.75% to 1%. At a post-meeting press conference, Powell suggested that Fed officials continue to raise rates by half a point, at the June and July meetings.

The Federal Reserve Chairman seemed unconcerned this week about the sharp decline in the US stock market over the past six weeks. Those declines partly reflect concern on Wall Street that the Fed’s efforts to rein in inflation, which is at its highest levels in 40 years, could weaken the economy as much as lead to a recession. Stock prices often also fall as interest rates rise, increasing the yield on bonds.

When asked whether a rate hike by the Fed could disrupt financial markets, without necessarily lowering inflation, Powell replied, “I don’t expect that to happen.”

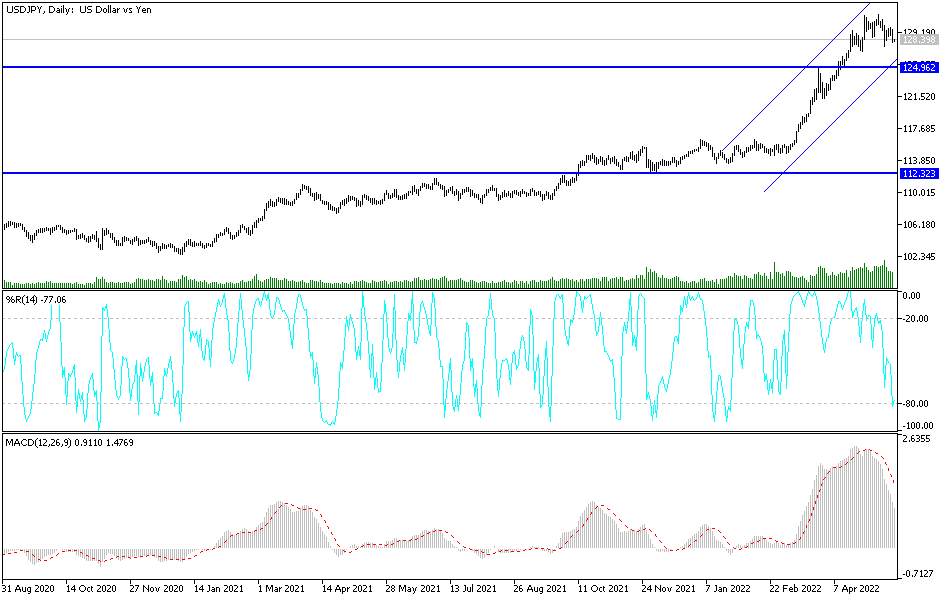

The USD/JPY currency pair has not exited the path of its ascending channel, and according to the performance on the daily chart below, this may happen if the currency pair moves towards the support levels 126.80 and 125.00. On the other hand, and in the same time period, stability above the psychological resistance 130.00 will be important for the bulls to regain control of the trend again. The US dollar pairs will be affected today by the weekly jobless claims, Philadelphia manufacturing index and US existing home sales.

[ad_2]