[ad_1]

If we do break down below the 1.20 handle, it will almost certainly bring in a new wave of extreme bearishness and fear trading around the world.

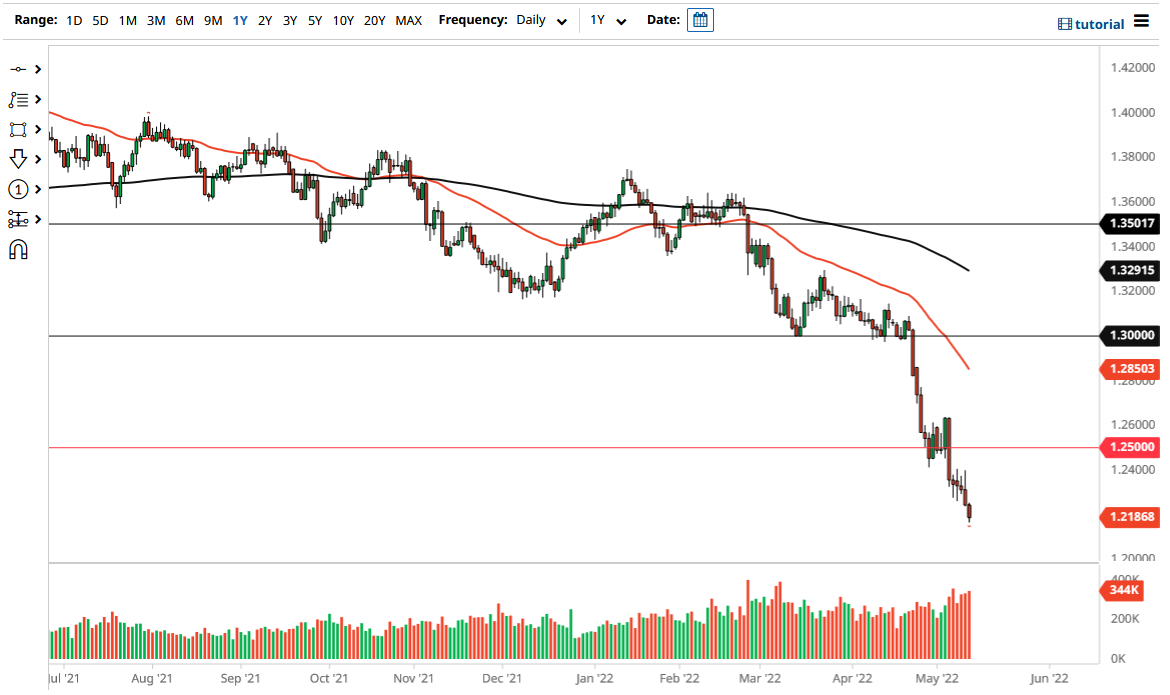

The British pound has fallen hard during the trading session on Thursday to show signs of weakness. We have broken through the 1.22 level, which is a very negative sign indeed. Ultimately, this suggests that we are going to continue to see downward pressure, and now it looks as if the market could even drop all the way down to the 1.20 handle.

The Bank of England has already suggested that a recession is coming to the United Kingdom, and at this point in time, it looks as if the Federal Reserve is going to do everything it can to cause a recession as it has to tighten monetary policy in order to drive down demand. Interest rates are going much higher in the United States, right along with inflation. At this point, it is going to be difficult to bet against the greenback, as we have seen so much in the way of massive momentum.

Any rally at this point in time should be thought of as an opportunity to short the market because it has so much directionality to it. The 1.25 level above is a significant round number that a lot of people will pay close attention to. I think that any time we rally anywhere near there, the first signs of exhaustion will be jumped upon. It is difficult to imagine a scenario where the US dollar suddenly sells off, unless of course some type of short squeeze, but that is about it. Ultimately, I think that this market will find one way or another to break down, especially as the Bank of England has already made a slight pivot to dovish in its, as it suggested that it was going to keep its balance sheet rather large.

The Federal Reserve has given absolutely no indication that they are willing to change course, and therefore it makes quite a bit of sense that we would see the downward pressure continue to overwhelm the market. Yes, we have fallen apart quite drastically, and we are probably due for some type of relief rally, but that will be an opportunity to pick up “cheap dollars.” If we do break down below the 1.20 handle, it will almost certainly bring in a new wave of extreme bearishness and fear trading around the world.

[ad_2]