[ad_1]

For the second day in a row, gold prices are trying to recover, reviving the momentum of safe haven buying after falling to its lowest level in 3 months. It reached the support level of $ 1832 an ounce. The rebound gains brought it to the level of $ 1858 an ounce before prices settled around the level of $ 1851 an ounce at the time of writing the analysis. The results of economic data showed that the annual rate of consumer price growth in the United States of America slowed less than expected in the month of April.

A sluggish dollar and lower bond yields also contributed to the rise in the price of gold. The dollar index fell to 103.37 from a high of 104.11, and was hovering around 103.85 a short time ago, slightly down from the previous close.

Data from the Labor Department showed that the annual rate of consumer price growth in the US slowed less than expected in April. The data said consumer prices in April rose 8.3% compared to the same month a year ago. While the annual growth rate slowed from a 40-year high of 8.5% in March, economists had expected the pace of growth to slow to 8.1%. Energy prices rose 30.3% year-on-year, while food prices increased 9.4%, reflecting the largest annual increase since the period ending April 1981.

The annual rate of growth in core consumer prices, excluding food and energy prices, also slowed to 6.2% in April from 6.5% in March, although the rate was expected to slow to 6%. On the other hand, consumer price inflation in China rose in April amid the closures, while factory inflation rates fell to their slowest levels in a year. April from 7.3% in March. The inflation rate is at its highest level ever since German reunification and is in line with flash estimates published on April 28.

Gold prices fell as the dollar rose after a more-than-expected inflation report likely to force the Federal Reserve to introduce more tightening than initially thought. The US inflation report proves that Fed Chairman Powell made a mistake last week when he removed the option to raise interest rates by 75 basis points at the next policy meeting. However, the overall takeaway for most of Wall Street is that the Fed is still willing to deliver consecutive half-point rate increases at the June and July FOMC meetings.

Gold gave up most of its gains after the inflation report but found massive support around the $1,830 level, which is where the small 200-day move is located. Gold was close to showing signs of stabilization as many investors had been hoping for a sharper slowdown in pricing pressures, which should have set the stage for a weaker dollar and a peak as Treasury yields soar.

Gold is initially holding at $1,830 and should continue to stabilize, but that could be tested if a steady wave of Fed talks raises market expectations for more aggressive tightening later this year.

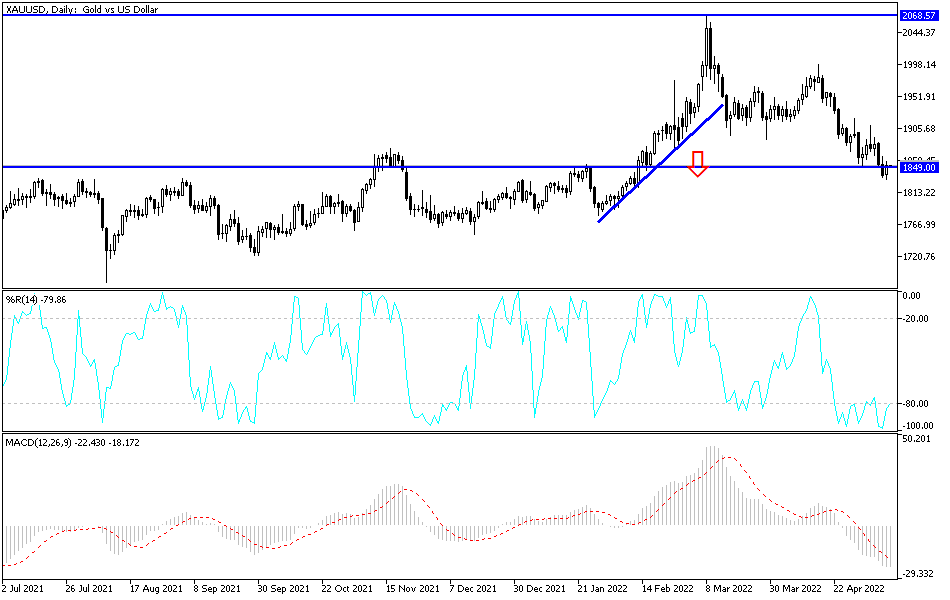

According to gold technical analysis: The recent recovery attempts did not remove the price of gold from the broader bearish path of performance according to the daily chart below. A reversal of that view may occur if the price of gold moves towards the resistance levels of 1875 and the psychological top of 1900 dollars an ounce again. As I mentioned before, I still prefer buying gold from every bearish level, and the closest support levels for gold are currently 1838 and 1820, respectively.

The price of gold will be affected today by the level of the US dollar and the extent to which investors are willing to risk or not, as well as the reaction from the course of the Russian-Ukrainian war, the epidemic situation in China and the reaction from the announcement of British growth and the rest of the US inflation figures and the weekly US jobless claims.

[ad_2]