[ad_1]

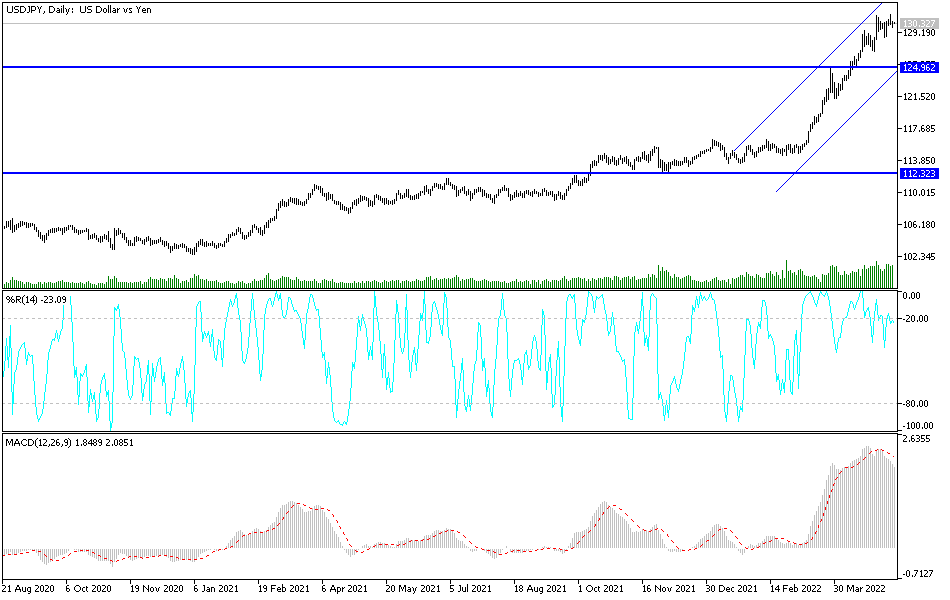

The stability around the highest levels in 20 years still characterizes the performance of the currency pair USD/JPY characterizes the performance of the currency pair for two consecutive weeks. The psychological top 130.00 still characterizes the dominance of the bulls. The US dollar is still the strongest against the rest of the other major currencies, supported by the expectations of raising US interest rates strongly during the year 2022 to contain the highest US inflation in 40 years. In return, the Central Bank of Japan provides more stimulus to the Japanese economy, which is suffering from the consequences of the epidemic and the Russian / Ukrainian war.

On the other hand, inflation of just 2% – relatively low in the current global wave of income-eroding price hikes – is likely to be enough to turn the real earnings of Japanese workers into negative, according to Oxford Economics.

Norihiro Yamaguchi, chief economist at Oxford, expects Japanese consumer prices to rise 1.7% this year, close to the Bank of Japan’s target of 2%. While this is more moderate than in many other economies, he said in a research note, real income in Japan will decline faster than in France, Australia, and other Asian countries due to modest gains in nominal income.

“The continued stagnation in the labor market in terms of working hours will affect the wages of part-time workers,” Yamaguchi added. And “for regular workers, traditional spring negotiations are likely to settle at a level that provides limited monthly wage increases throughout 2022.”

With working hours stagnating, labor market conditions in Japan are becoming more resilient than suggested by a 2.6% drop in the unemployment rate, Yamaguchi said. While inflation in Japan is quieter than elsewhere, households still face a steep rise in the cost of living from the fastest gains in energy prices in decades. Weak wages are a major reason why the central bank has committed to strict monetary easing in an effort to put the economy on a more sustainable recovery path.

About 3,300 unions in Japan achieved a 2.1% increase in average monthly wages in this year’s wage negotiations, according to Rengo, the largest trade union umbrella organization. Yamaguchi added that as smaller companies are added to the tally, the rise is likely to be curtailed somewhat. This week’s data showed Japan’s real wages fell 0.2% in March, the first decline in three months, as inflation weighed on household incomes. This is expected to affect consumption, which began to recover after virus restrictions were removed in late March.

According to the technical analysis of the pair: Today, the US dollar pairs are awaiting the announcement of US inflation figures, which will have a reaction to the expectations of raising US interest rates. In general, there is no change in my technical view of the price performance of the USD/JPY currency pair, as the general trend is still bullish and the psychological top of 130.00 is a culmination of the extent to which the bulls control the trend. Forex investors do not care about technical indicators reaching overbought levels after the pair’s recent gains. Continuing factors of the dollar’s strength, especially the future tightening of the US Federal Reserve’s policy, will remain an important factor for the bulls.

Currently, the best selling is waiting for profit taking operations from the resistance levels 131.30 and 132.20, respectively. On the other hand, it broke the support 128.00, a first penetration for the current upward trend.

[ad_2]