[ad_1]

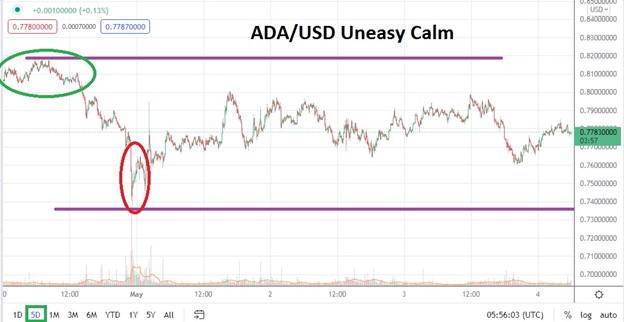

ADA/USD is lingering near unsettling support levels, and speculators who have been trying to seek a reversal higher may be growing uneasy.

ADA/USD is hovering near the 78 cents level as of this writing, and important support levels are within sight. The broad cryptocurrency market is showing a rather widespread amount of nervous sentiment as many of the major digital assets linger near extremely important mid-term support and many others are within shouting distance of long term junctures.

ADA/USD is remarkably close to both mid and long term support levels. If buyers remain in a non-supportive mode and the price of Cardano continues to erode, ADA/USD could with one swift stroke of volatility suddenly be next to depths it has not traversed since early February of 2021. Current support levels of 77 cents have been flirted with recently and the inability of ADA/USD to provide a solid reversal higher is troubling.

Optimistic speculators who have bought ADA/USD may still be waiting for additional buyers to step into the market, but will they arrive? Incrementally the trend remains bearish, there is no way to sugar coat this technical viewpoint. While some traders may point to the current depths being tested by ADA/USD as a great opportunity to buy when the price is cheap, others may believe value of Cardano can drop lower.

Traders should expect volatility near term because of the consolidation many of the major cryptocurrencies are displaying near critical support levels. The uneasy calm in digital assets is unlikely to remain and speculators should be braced for the potential of violent trading. The question day traders need to consider is where the greatest amount of risk and reward can be perceived. Because of the rather weak reversals upward, and the almost daily flirtation with lower values, negative sentiment seems to be the stronger potential impetus.

If the 78 cents ratio fails to be sustained by ADA/USD, traders could not be blamed for thinking lower depths will be explored. If ADA/USD were to fall below the 0.77550000 mark and not be able to climb above this mark in the near term, it could set off a test of the 77 and 76 cents junctures.

Certainly there will be slight reversals higher, but the question is how much strength these moves will generate. Conservative traders may want to use slight moves upward as a way to ignite their short positions with entry price orders above current market values. Speculators need to understand that if the current quiet market disappears, ADA/USD could become very fast and having risk management ready with stop loss and take profit orders could prove effective.

Cardano Short-Term Outlook

Current Resistance: 0.78480000

Current Support: 0.77350000

High Target: 0.90780000

Low Target: 0.80100000

[ad_2]