[ad_1]

The sharp strength of the US dollar recently contributed a lot to activating the selling of the gold market with losses to the level of 1872 dollars an ounce during the last seven trading sessions. This is the lowest for the price of gold in two and a half months. The strength of the dollar stopped on Friday, so the price of gold tried to compensate, but its gains did not exceed the level of 1920 dollars an ounce. It stabilized around the level 1896 dollars per ounce at the beginning of the trading of a very important week for the markets, as the US Federal Reserve will announce the increase in US interest rates for the first time in years. Any sharp tone for the bank in the path of raising interest rates will bring the gold price more losses.

In general, the price of the yellow metal will record a weekly and monthly loss. However, gold prices are up more than 4% so far this year 2022. Gold prices are on track for a weekly drop of about 1% and a monthly drop of about 0.8%. As for the price of silver, the sister commodity to gold prices, it is looking to stay above the $23 level in May. The price of the white metal fell by 3.95% last week and more than 6% in April. Since the beginning of the year 2022 to date, silver prices have decreased by 0.5%.

Gold prices benefited from the dollar’s weakness as the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 103.25, from an opening at 103.67. A weaker dollar is beneficial for dollar-priced commodities because it makes them cheaper to buy for foreign investors.

Gold’s gains were capped by a bond market boost, with the 10-year US Treasury yield rising 0.047% to 2.91%. One-year Treasury yields increased 0.073% to 2.074%, while 30-year yields increased 0.039% to 2.968%.

The yellow metal – gold – is sensitive to a higher rate environment because it increases the opportunity cost of holding non-returning bullion.

Gold prices also rose on the back of higher inflation as the PCE price index rose at an annualized rate of 6.6% in March. The personal consumption expenditures price index, the Fed’s preferred inflation measure, also rose 0.9% month over month in March. Staffing costs rose 1.4% in the first quarter, beating market expectations of 1.1%.

In other metals markets, copper futures settled at $4.4105 a pound. Platinum futures rose 1.45%, to $924.30 an ounce. Palladium futures jumped to $2,298.50 an ounce.

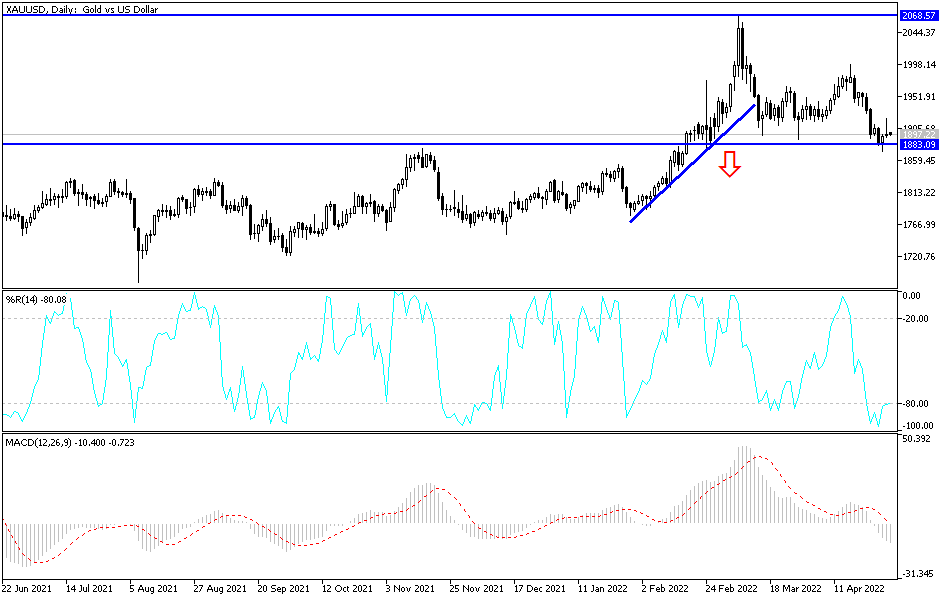

According to the technical analysis of gold prices: In the near term and according to the performance of the hourly chart, it appears that the price of gold is trading within the formation of a descending channel. This indicates a slight bearish momentum in the short term in the market sentiment. Therefore, the bears will look to ride the current bearish momentum towards $1,873 or lower to $1,853. On the other hand, the bulls will target extended recovery profits at around $1,909 or higher at $1,931.

In the long term, and according to the performance on the daily chart, it appears that the price of XAU/USD is on its way to complete the formation of the XABCD reversal pattern. This indicates an attempt by the bears to control the price in a volatile market. Therefore, the bears will be looking to extend the current downside move towards $1,838 or lower to $1,789 an ounce. On the other hand, the bulls will target long-term profits at around $1,951 or above at $2000 an ounce again.

[ad_2]