[ad_1]

Crude oil markets have seen a lot of volatility, but it does look like we are compressing for a bigger move sooner or later.

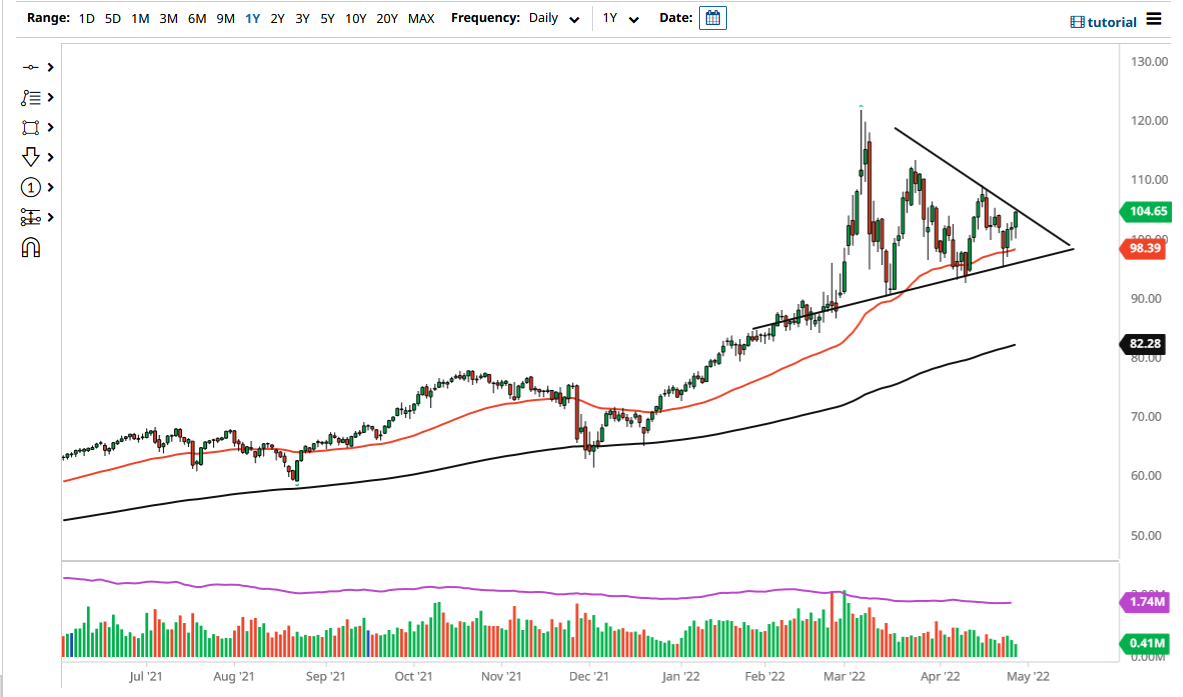

The West Texas Intermediate Crude Oil market initially fell during trading on Thursday but has found plenty of buyers near the $100 level. This is an area that would attract a lot of attention since there is a lot of psychology in this area and it slices right through the middle of a larger triangle that I have drawn on the chart.

There are a lot of things going on at the same time when it comes to the crude oil market, not the least of which would be supply constraints. There have been a lot of concerns when it comes to supply the world with enough crude oil, especially as there are a lot of issues facing Russian supply. Furthermore, the market has recently just reopened from the pandemic, so a shock to the system makes quite a bit of sense as there will be a sudden surge in demand.

However, as the GDP number showed in the United States on Thursday, there are concerns about economic growth slowing down. In that scenario, the demand for crude oil could start to fall. This is part of what we have been dealing with as of late, so I do think we will continue to see a lot of choppy behavior. However, it certainly looks as if the buyers are starting to step up the pressure, if we can take out the $105 level to the upside, we might have the beginning of a move to attack the $110 level.

Underneath, I see the 50 Day EMA as offering dynamic support at the $98.38 level. The $100 level itself will also offer support as it has that psychology attached to it and previous action. Because of this, I think we have a situation where buyers will continue to return on dips, and as soon as we can break out of this triangle, we may have a bit more clarity as to where we are going long term. In that scenario, I do believe that the uptrend will continue. I suspect that it is more likely the case than not.

Crude oil markets have seen a lot of volatility, but it does look like we are compressing for a bigger move sooner or later. I suspect we are getting very close to seeing all of the answers to this question played out.

[ad_2]