[ad_1]

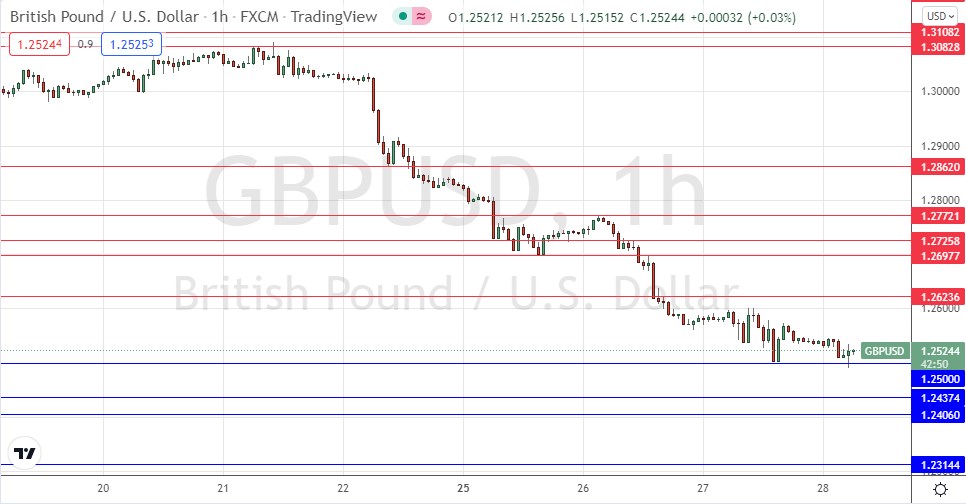

The price is reaching new 18-month lows.

My last GBP/USD signal on 12th April produced both a profitable long trade from the rejection of the support level at $1.3000 and a profitable short trade from the rejection of $1.3052, so it was a good signal.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered today between 8am and 5pm London time.

- Go long following a bullish price action reversal on the H1 time frame timeframe immediately upon the next touch of $1.2500, $1.2437, or $1.2406.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of $1.2624, $1.2698, or $1.2726.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote in my last piece on 12th April that the best approach here would be to wait for the price to reach $1.3000 and be prepared to take long scalping trades, which could be left to run into potentially longer-term trades as this level may begin to act as long-term support. Yet the bigger opportunity will potentially be a strong breakdown below $1.3000 as there are no support levels below that for 200 pips at least.

This was an excellent call, both for that day and for the longer-term outlook, as we got a bullish bounce early in the London session off $1.3000, but the final breakdown below $1.3000 which took many days to happen triggered a very strong 500-pip breakdown over just a few days.

The price has fallen hard with very strong momentum. The US Dollar is advancing to new long-term highs but is advancing especially strongly against the Euro and the British Pound. This is partly due to poor UK economic data releases and the IMF’s major downgrading of its forecast for UK economic growth, but also due to the economic impact of the war in Ukraine, with concerns exacerbated yesterday as Russia cut off its gas supplies to Poland and Bulgaria, although these nations are not part of the Eurozone.

Technical analysis of course shows extremely strong bearish momentum into new 18-month lows, which is usually very foolish to bet against on the long side. However, at the time of writing, we are seeing some initial support happen here at the big round number of $1.2500 at the same time as we see support in the EUR/USD at $1.0500. This confluence may be a technical barrier against further US Dollar gains, at least over the short-term. It is also true that the Pound has been firmer over the past day than the Euro has.

Today I would be very happy to take a short trade from a bearish reversal from $1.2624 if it sets up. Skilled scalpers may want to try for long scalps from $1.2500.

If the price can get established below $1.2500 soon, that will be a bearish sign, and we will then probably see the price resume its strong downwards movement.

Regarding the USD, there will be a release of US Advance GDP data at 1:30pm London time,. There is nothing of high importance scheduled for today concerning the GBP.

[ad_2]