[ad_1]

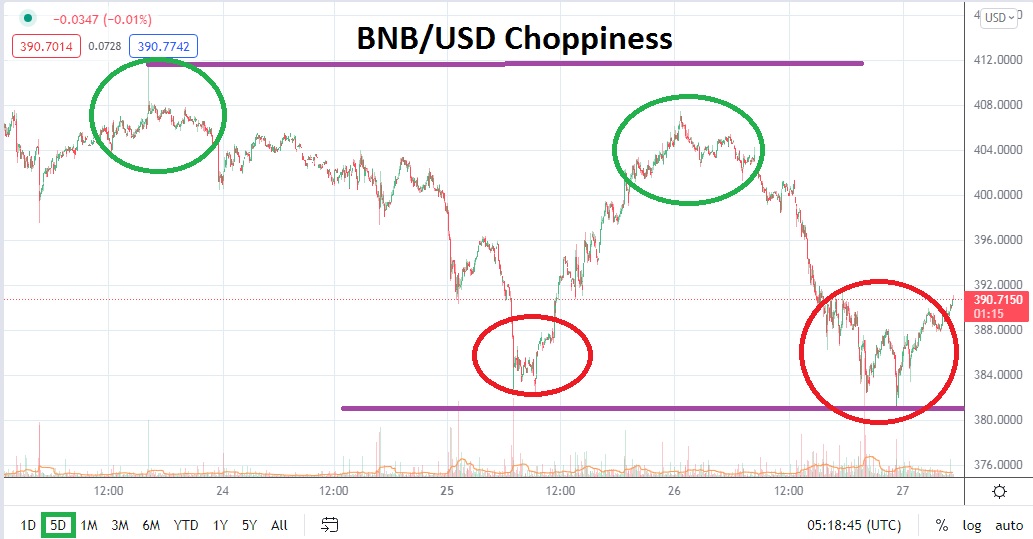

BNB/USD has demonstrated a serious amount of choppiness the past five days and its volatile results are not likely to end soon, creating speculative opportunities.

Day traders who enjoy a speculative wager with quick hitting results may be tempted to look at BNB/USD. The results in Binance Coin the past week of trading have been choppy, and while they have mirrored many of the major cryptocurrencies, BNB/USD also famously marches to its own drumbeat. As of this writing BNB/USD is below the 392.0000 ratio and conditions are fast.

In late trading last night BNB/USD slipped to nearly 380.0000 and then reversed higher. Because of its relatively large value per coin, BNB/USD may not produce the rapid fire percentage changes some speculators crave. Yet with a limited amount of leverage and the fact that solid volumes often create swift changes in value, Binance Coin remains a favorite of traders while searching for rapid outcomes.

Moves of a couple of USD within a few minutes are common in BNB/USD, and traders are urged to use entry price orders when wagering to make sure their fills meet expectations. Day traders looking for quick results can use take profit and stop loss orders, and produce results within a limited amount of time that some may find quite attractive. While behavioral sentiment in the cryptocurrency market remains nervous, choppy displays of value have become commonplace the past few days.

BNB/USD is within sight of one month lows, and those depths were actually created late last night. While the reversal upwards in the past handful of hours may be tempting for speculative bulls to dream of higher prices, the move upwards may also tempt traders to believe another leg down may be exhibited rather soon too via another reversal.

The 390.0000 support level should be watched carefully, if this juncture fails to hold back selling pressure another swift burst of downward pressure may mount. Binance Coin is a major cryptocurrency which certainly can be a barometer of market sentiment due to its use as a utilitarian digital asset to trade other cryptocurrencies. Support levels are still be within sight of technical traders. If mid-March values in BNB/USD near the 380.0000 were to suddenly become vulnerable this would certainly add to nervousness.

Choppy technical conditions in the short term will certainly lead some traders to chase nearby support and resistance levels. However traders should be cautious about violent moves downwards. From a risk reward perspective there appears to be a greater chance for a larger amount of selling to be produced near term, compared to a sudden thrust upwards which penetrates distant resistance levels.

Binance Coin Short-Term Outlook

Current Resistance: 392.0700

Current Support: 388.6500

High Target: 401.1000

Low Target: 381.2900

[ad_2]