[ad_1]

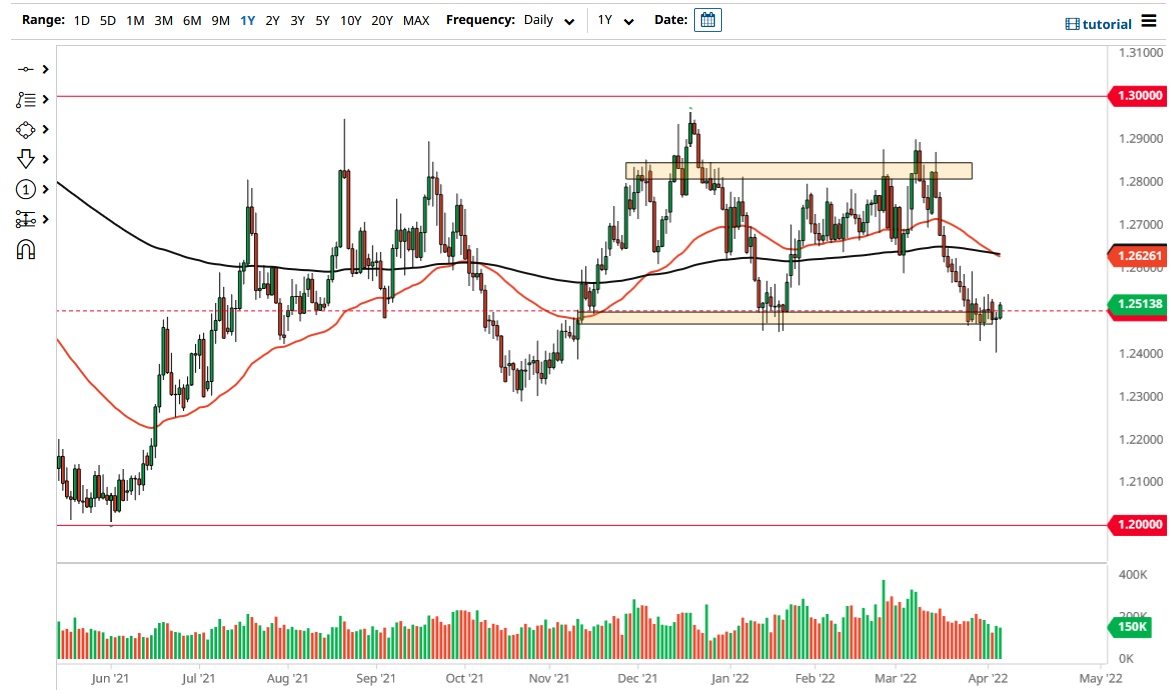

I think that selling is all but impossible until we break down below the hammer.

The US dollar rallied significantly on Wednesday to break above the top of the hammer from the previous session, suggesting that we are in fact trying to recover overall. The market continues to hang about the 1.25 handle, which is a large, round, psychologically significant figure, and an area where we have seen a bounce previously. Because of this, I think it is more likely than not that we are going to see an attempt to stay within the longer-term consolidation area.

Another thing that helps the idea of this going higher is the fact that the FOMC Meeting Minutes were a bit more hawkish than a lot of traders had anticipated, and we have seen a spike in the US dollar overall during the trading session. Furthermore, the crude oil markets have broken down rather significantly as a surprise inventory builds and a softening of demand for gasoline has come into the picture as well. Looking at this chart, it is likely that if we can break above the top of the candlestick for the trading session on Wednesday that could open up a move to the 50-day EMA, perhaps even as high as the 1.28 level over the longer term.

The alternate scenario is that we will turn around and break down below the 1.24 handle, which would be a breakdown of the hammer that we had just formed. If you break down below the hammer, then it is going to be very negative for the US dollar, and we could see a spike in the value of the Canadian dollar. Because of this, I think is very likely that the selling pressure would pick up drastically and it could speed up.

That being said, when you look at the candlesticks over the last couple of weeks, we have seen the real body of each candlestick trend, and now we are starting to swing in the opposite direction. The explosive move during the trading session on Wednesday could be the beginning of a complete recovery, but obviously, it is going to take some time to determine whether or not that is going to be the case. Because of this, I think that selling is all but impossible until we break down below the hammer.

[ad_2]