[ad_1]

The problem is that markets are trying to price in a recession, but at the same time trying to pressure the Federal Reserve into supporting Wall Street in order to keep them from losing money.

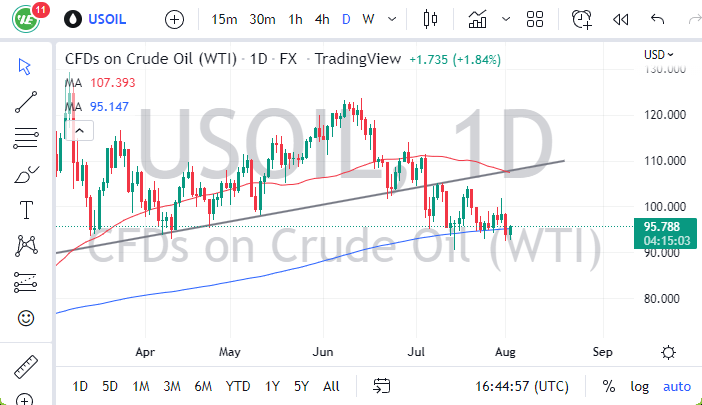

- The West Texas Intermediate Crude Oil market rallied a bit Tuesday as we continue to hang around the 200-day EMA.

- This is a market that is all over the place, and probably won’t be changing that attitude anytime soon.

- Yes, there has been a serious supply disruption over the last year and ½ or so, but at the end of the day, the question then becomes whether or not there is going to be enough demand.

Beware of Volatility

With this being the case, I think you need to continue to see this as a market that can only be traded in short-term increments, as the nonsense continues to accelerate. Volatility is getting worse, and you will need to be very nimble to trade the crude oil market. That being said, I don’t necessarily feel like it’s a market that I have to be involved in, so until we get some type of clarity on the economic direction of the world, it’s difficult to put a lot of money into this market one way or the other.

It’s worth noticing that the $100 level above should be resistant, so if we do rally a bit, then signs of exhaustion could be jumped upon as we go back and forth. On the other hand, if we get a daily close above the shooting star from Friday, then it’s possible that we could go looking to reach the 50-day EMA. On the other hand, if we were to turn around and break down below the $90 level, then we could drive down to the $80 level.

This market does tend to pay close attention to the 200-day EMA, so I think that’s part of what’s going on, but the reality is that people have no idea what the demand picture is going to be going forward, and anybody who tells you this is lying. The problem is that markets are trying to price in a recession, but at the same time trying to pressure the Federal Reserve into supporting Wall Street in order to keep them from losing money. That’s what they’ve done for 13 years, so it’ll be interesting to see whether or not Jerome Powell chooses to do that going forward or not.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

[ad_2]