[ad_1]

Our expectations suggest that natural gas will rise during its upcoming trading.

Spot natural gas prices (CFDS ON NATURAL GAS) stabilized at a decline in recent trading at intraday levels, to record daily losses until the moment of writing this report, by -1.30%. It settled at the price of $8.223 per million British thermal units, after a decline in a volatile session yesterday. By -0.99%.

Wholesale gas prices in Britain and the Netherlands were mixed on Tuesday due to continuing uncertainty over Russian gas supplies.

Physical flows through Nord Stream NS1 rose slightly on Tuesday, but uncertainty about flows now operating at just 20% of total pipeline capacity is making market players worried about Europe’s ability to build storage before winter.

“Adjusted LNG flows, rising UK and Norwegian supplies and weak demand all put storage stocks in Northwest Europe in a seasonally good position,” analysts said in a global research report by Bank of America.

“However NS1 will need to operate again at 40% to push storage levels close to the 5-year average for the onset of winter. If Russia cuts NS1 to zero again gas stocks will likely struggle to reach their highest levels in 2021, and end-of-season storage may decline to dangerously low levels.

Amid expectations of cold weather and rising new production in the US over the weekend, September natural gas futures slipped, however weather models showing more heat for the East Coast quickly reversed the course of September gas futures in Nymex, the month settled Spot is up 5.4 cents at $8.283 per million British thermal units. October futures contracts rose 5.2 cents to $8,260.

Meanwhile, production continues to record new increases as NatGasWeather noted that output reached 97 billion cubic feet late last week, and settled at that level over the weekend. However, with the start of the new month, early data on Monday reflected a 1.5 billion cubic feet per day (bcfd) drop in production.

Meanwhile, recent factory activity data indicated that the world is headed for a major global economic downturn, with manufacturing data in China and Europe contracting while the US continues to weaken, raising concerns about the outlook for short-term energy demand.

Natural Gas Technical Outlook

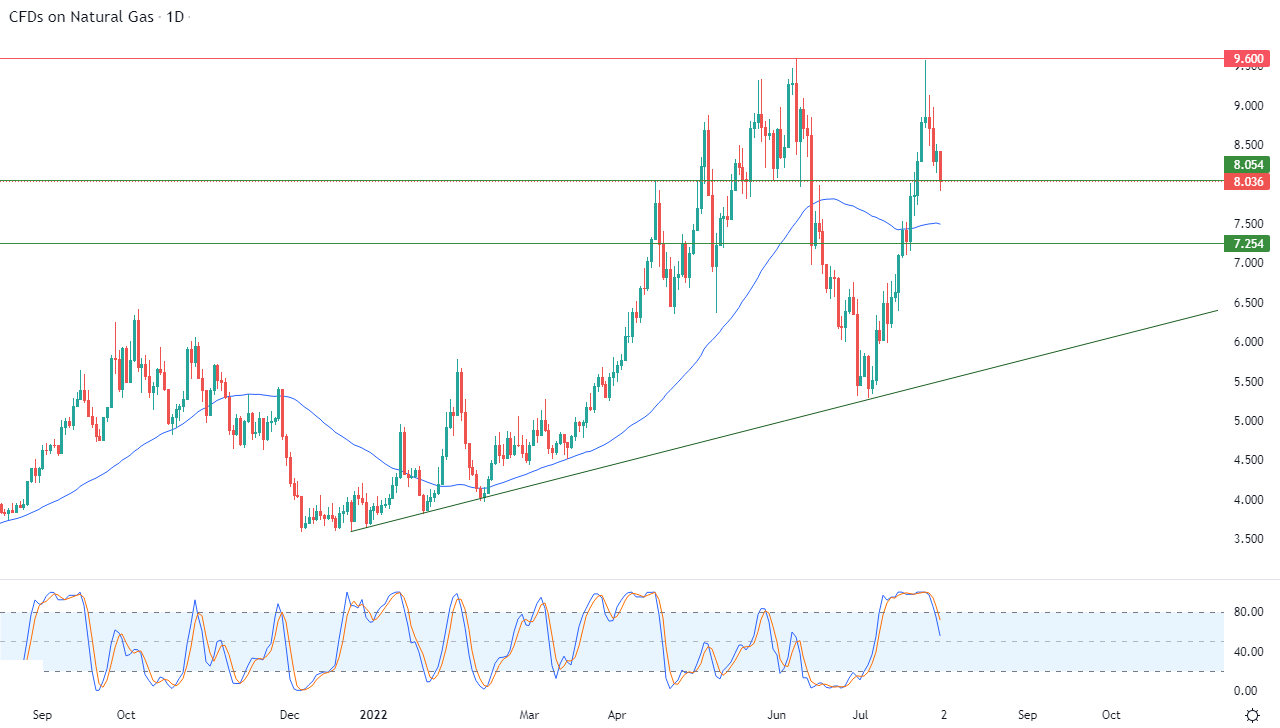

Technically, the price found some support in yesterday’s trading when it relied on the important support level 8.054, that resistance that we had referred to in our previous reports. This is amid its attempts to search for a bullish bottom to take as a base that might help it gain the necessary positive momentum to regain its recovery and rise again. It is also trying to discharge some of their clear overbought by the relative strength indicators, especially with the influx of negative signals from them.

All of this comes in light of the dominance of the main bullish trend over the medium and short term along a slope line, as shown in the attached chart for a (daily) period, with the continuation of positive support for its trading above its simple moving average for the previous 50 days.

Therefore, our expectations suggest that natural gas will rise during its upcoming trading, as long as the support 8.054 remains intact, to target again the pivotal resistance level 9.600.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

[ad_2]