[ad_1]

The market continues to be a “buy on the depth” scenario, and we need to play it as such.

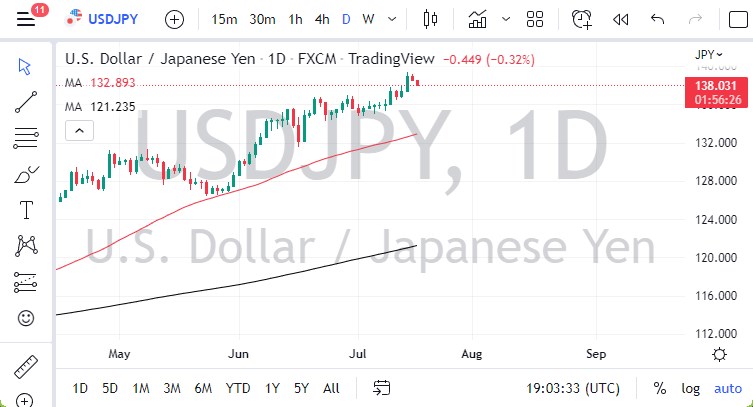

The US dollar pulled back a bit Monday to show signs of hesitation. That being said, the ¥138 level looks to be a bit supportive, and I think we will be paying close attention to it. If we break it down below there, then the ¥137 level gets targeted, followed by the ¥136 level.

The yen is a popular asset during turbulent times.

The market has been in a strong uptrend for a while, so this pullback is probably necessary. That being said, it’s difficult to imagine that we are suddenly going to turn things around any time soon. Because of this, the market is likely to see a lot of noisy behavior, but I think eventually we will have buyers coming back into the picture to pick things up. The 50-day EMA is sitting just below the ¥134 level and rising, so I think it’s probably only a matter of time before we see dynamic support come back into the market based upon that as well.

The large candlestick from the Thursday session suggests that we are going to go higher in the longer term, so if we were to break above that impulsive candlestick, it’s likely that we would have more momentum entering the market, perhaps reaches to the ¥140 level rather quickly. Because of this, I think it continues to be a “buy on the dips” type scenario, especially as the Federal Reserve is going to continue to be very tight with its monetary policy, and therefore it should continue to work against the value of the yen when measured against the greenback. Ultimately, the market continues to be a “buy on the depth” scenario, and we need to play it as such.

If we were to see a lot of negativity, it’s possible that we could see an opportunity to pick up value. If we were to break down below the 50-day EMA, then it could be a much bigger deal, but ultimately, I think the market will have to pay a certain amount of attention to that indicator because it will cause a lot of noisy behavior, and perhaps a lot of headlines that people will pay close attention to. I think the Japanese yen will continue to suffer at the hands of the Bank of Japan entering quantitative easing so aggressively.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]