[ad_1]

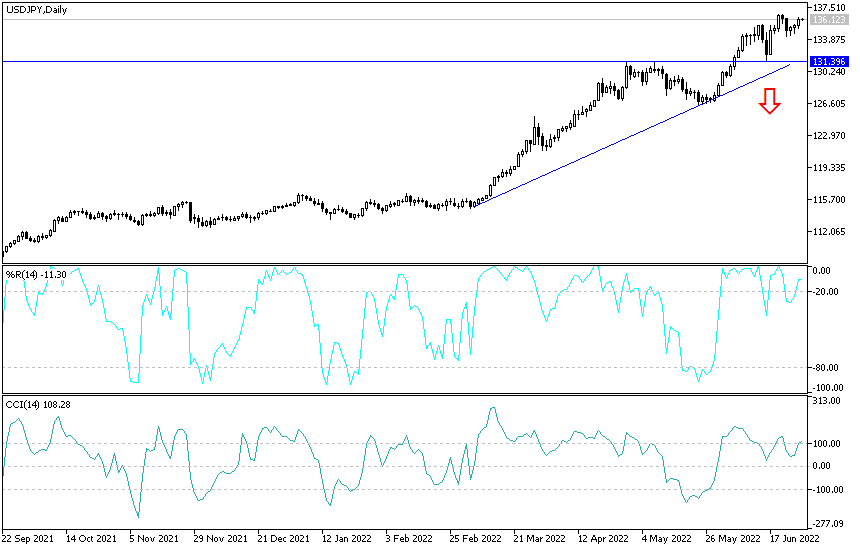

Before the announcement of the growth rate of the US economy, which is an important statement about the expectations of raising US interest rates, it pushed the price of the US dollar against the Japanese yen (USD/JPY) towards the 136.72 resistance level.

This is its highest in 24 years. For four trading sessions in a row, the dollar-yen pair is recovering from recent selling operations that pushed it towards the 134.35 level and settles around the 136.38 level.

Yesterday it was announced that inflation in Japan has increased rapidly to the largest share of items in two decades, as the Bank of Japan waits for wage growth to accompany price hikes. The proportion of price-raising items in Japan’s core consumer price basket rose to 69.2% last month, the most in data going back to January 2001, according to a statement from the central bank published on Tuesday.

The outcome is unlikely to convince BoJ Governor Haruhiko Kuroda to change his relaxed stance. He has repeatedly insisted that current input-cost inflation must first become more sustainable, buoyed by wage growth and the recovery from the pandemic. However, signs of broad-based price increases are likely to continue to fuel speculation around a shift to normalization. Bond traders and hedge funds are already betting that the Bank of Japan will have to raise its 10-year yield ceiling or abandon the yield curve control framework altogether. Yesterday’s report also showed the cut-off average, another key indicator of price direction, reaching a new high, up 1.5%.

Japanese consumer prices excluding fresh food rose 2.1% from a year earlier in May, with energy costs rising due to a weaker yen, according to a government report last week.

On the other hand, before the announcement of important US economic data. US consumer confidence was reported to have fallen to its lowest level in more than a year in June as inflation continued to dampen Americans’ economic sentiments. Accordingly, Tuesday’s data showed that the Conference Board’s index of US consumer confidence fell to a reading of 98.7 from a downwardly revised reading of 103.2 in May. The median forecast in a Bloomberg survey of economists called for a dip to 100. The expectations gauge – which reflects consumers’ six-month expectations – fell to its lowest level in nearly a decade as Americans became more pessimistic about the outlook for the economy, labor market and incomes. The group’s measure of current conditions has decreased slightly.

USD/JPY Analysis Today:

The general trend of the USD/JPY currency pair is still bullish. As mentioned before, there is a clear disregard by Japanese officials, whether the government or the Central Bank of Japan is for the continued collapse of the Japanese yen. This may allow the dollar-yen pair to move towards the historical resistance level of 140.00 at any time. It is the specified level of Japanese officials that may intervene in the markets to stop more of it.

The US dollar is still the strongest with the expectations of raising US interest rates strongly during the year 2022. The Japanese economy is receiving continuous stimulus and is not completely excluded near the date of the tightening of the Japanese central policy. There will not be an initial break of the trend without moving towards the 130.00 support, otherwise the bulls will remain in control.

[ad_2]