[ad_1]

Japanese officials’ ignoring of the continuous collapse of the Japanese yen exchange rate, along with the US Federal Reserve’s continued intention to raise US interest rates strongly during 2022, are still important factors for the continuation of the strong upward trend of the US dollar against the Japanese yen pair, with gains to its highest in 24 years. Its recent gains brought it to the resistance level of 136.72 and it settles around the level of 135.48 at the time of writing the analysis.

Amid the US central bank’s leadership of global central banks to raise interest rates to contain historical inflation. Bank Chairman Jerome Powell reiterated the comments he already made at the press conference after the June decision to raise the US interest rate by a massive 0.75%, raising it to 1.75%, although its impact was more pronounced on the stock and bond markets last week.

The US dollar’s declines last week were in contrast to its usual reaction to market concerns about the outlook for the global economy and many analysts still expect it will benefit from any further deterioration. Accordingly, the could rise to 106 pips this week. “The increased risks of a global recession, or at least a sharp slowdown, support further gains in the US dollar,” says Joseph Caporso, an analyst at the Commonwealth Bank of Australia.

All this leaves much to be determined this week by a flurry of important economic numbers from the US in the coming days, which includes the May edition of the Fed’s favorite inflation gauge; Core personal consumption expenditures price index. The consensus expects the core PCE price index to rise 0.4% last month, up from 0.3% previously, but from 4.9% to 4.8% year over year. Commenting on this, Kevin Cummins, chief US economist at Natwest Markets, says: “Not all of the strength in core CPI (such as airfare and auto insurance) will be fed into the core PCE deflation.”

We expect core PCE deflator to advance 0.4% (0.383% unrestricted), stronger than the 0.3% streak of gains in the previous three months but still less than the 0.6% gain in core CPI. On an annualized basis, our realization of our forecast would pull the core PCE inflation rate from 4.9% in April to 4.7% in May as the 0.6% rise from last May is off the mark.”

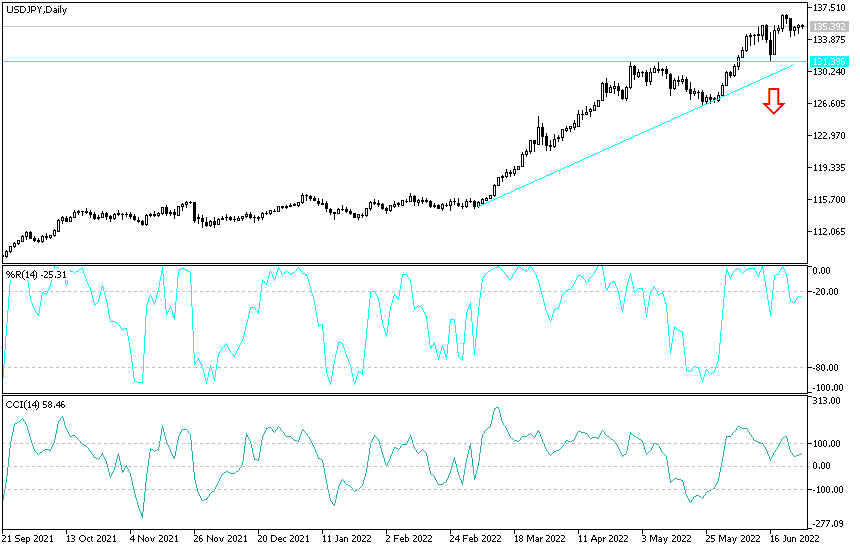

USD/JPY Analysis:

The general trend of the dollar yen currency pair is still bullish. Despite the technical indicators reaching strong overbought levels after the recent record gains, the continuation of the above mentioned factors guarantees the currency pair to continue to test ascending level. The closest to it is currently 136.20 and 137.00, respectively, and stability above the last level will strengthen expectations with a stronger upward move, psychological resistance 140.00 may be the ideal destination for the bulls.

On the downside, there will be no first break of the trend without moving below the 130.00 level. The USD/JPY currency pair will be affected today by the extent to which investors take risks or not, in addition to the announcement of the US consumer confidence reading.

[ad_2]